Portfolio Update Oct. 2024 - I added three new positions in September

September was an okay month for my portfolio. With markets at all-time highs and looking heated, I am in no rush to pick up more shares, either.

Welcome back to my monthly portfolio update!

As always, at the start of the new month, I will give you a detailed overview of my thoughts on the market and recent developments, some news highlights that stood out to me, and, of course, my portfolio performance, an overview of all my transactions (including motivation), and my full portfolio in graphs.

After a somewhat hectic September, including some sell-offs, a Fed rate cut, and a robust recovery resulting in new all-time highs once more exiting the month, there is plenty to discuss and plenty to anticipate for investors.

Even as markets are sitting at or around all-time highs, there remain plenty of opportunities out there, even if you might have to look a little further for them. At the same time, I also believe markets might be running too high on over-optimism. As a result, I was actually a net seller in September, selling more shares than I bought.

Of course, I’ll share all my views, opinions, and motivations in this post.

Yet, first of all, a quick content recap before we get started.

For those who are new here (obviously subscribe right now!) or for those who have missed some of my September posts, here is a quick overview of them. Make sure to check them out—there are some good reads here (all free!).

Lululemon Athletica, Inc. – Misunderstood and now an absolute bargain!

Lowe’s Companies, Inc. – A true SWAN stock, one I would love to own (Deep Dive)

Which stocks to buy today? I am loading up on these two (+2)! – Sept. 2024 Edition

Adobe Inc. – An opportunity amid AI fears or getting disrupted?

Universal Music Group – A Deep Dive into one of Bill Ackman’s favorite stocks

As always, the latter part of this post's content, including my transactions and portfolio, is for paid subscribers only. It gives premium insights into my buying activity and all the securities I hold.

Note that all my stock updates and Deep Dives are always free to read!

If you want full access to my portfolio, all my transactions, and market commentary (current sentiment), then now is the time to consider upgrading to paid for just $5 monthly or $50 per year. You’ll be able to follow my every move.

You can manage your subscription using the button below!

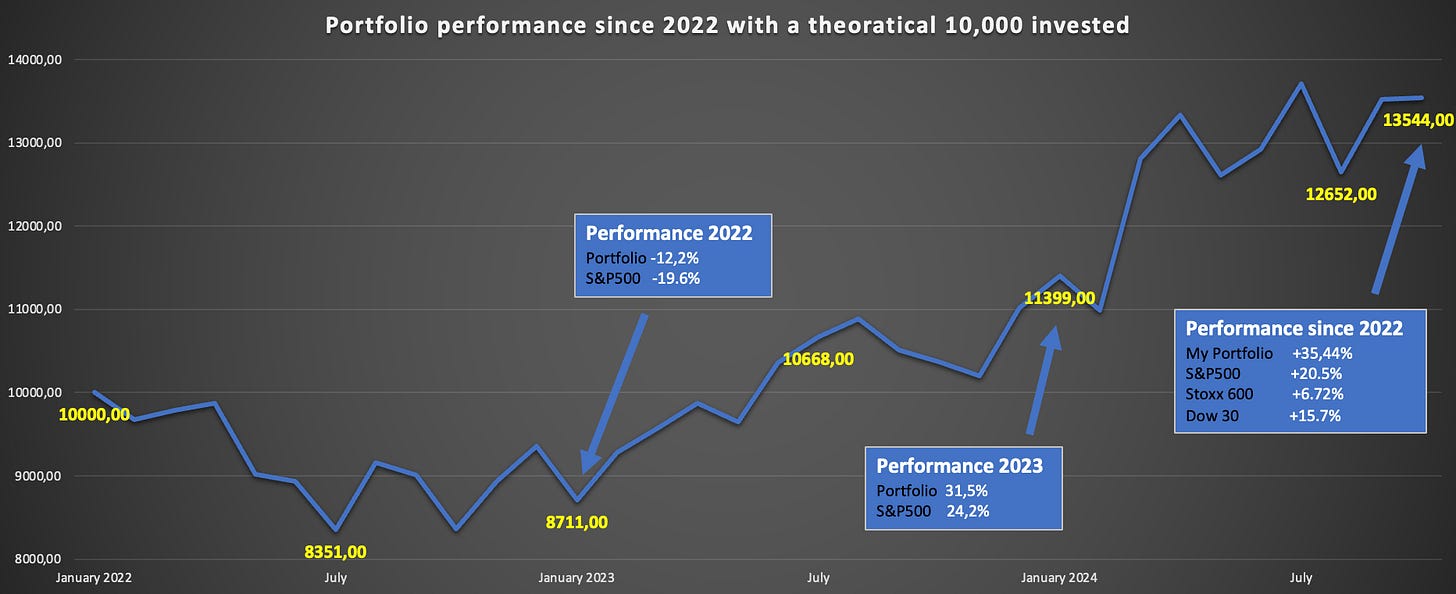

My performance? Since 2022, my portfolio has returned 35.4% vs. 20.5% for the S&P 500, at a below-average risk profile and a long-term view.

I appreciate all the support!

Stocks are expensive today as markets keep setting new highs - My quick take.

September was a really interesting month for investors, or at least, in my view. With U.S. elections heating up, the Fed cutting interest rates, economic indicators giving mixed signals, and the Chinese government again giving investors false hope with some economic stimulus, there is plenty to anticipate and react on.

We started the month with a tough sell-off, with the S&P 500 losing more than 2%, but we rapidly recovered, ending the month at a new all-time high, unsurprisingly. Positive news simply seems to continue outweighing all the negative news and uncertainty out there, including a number of wars and geopolitical tensions as well as struggling economies, which remains hard to explain, to be honest.

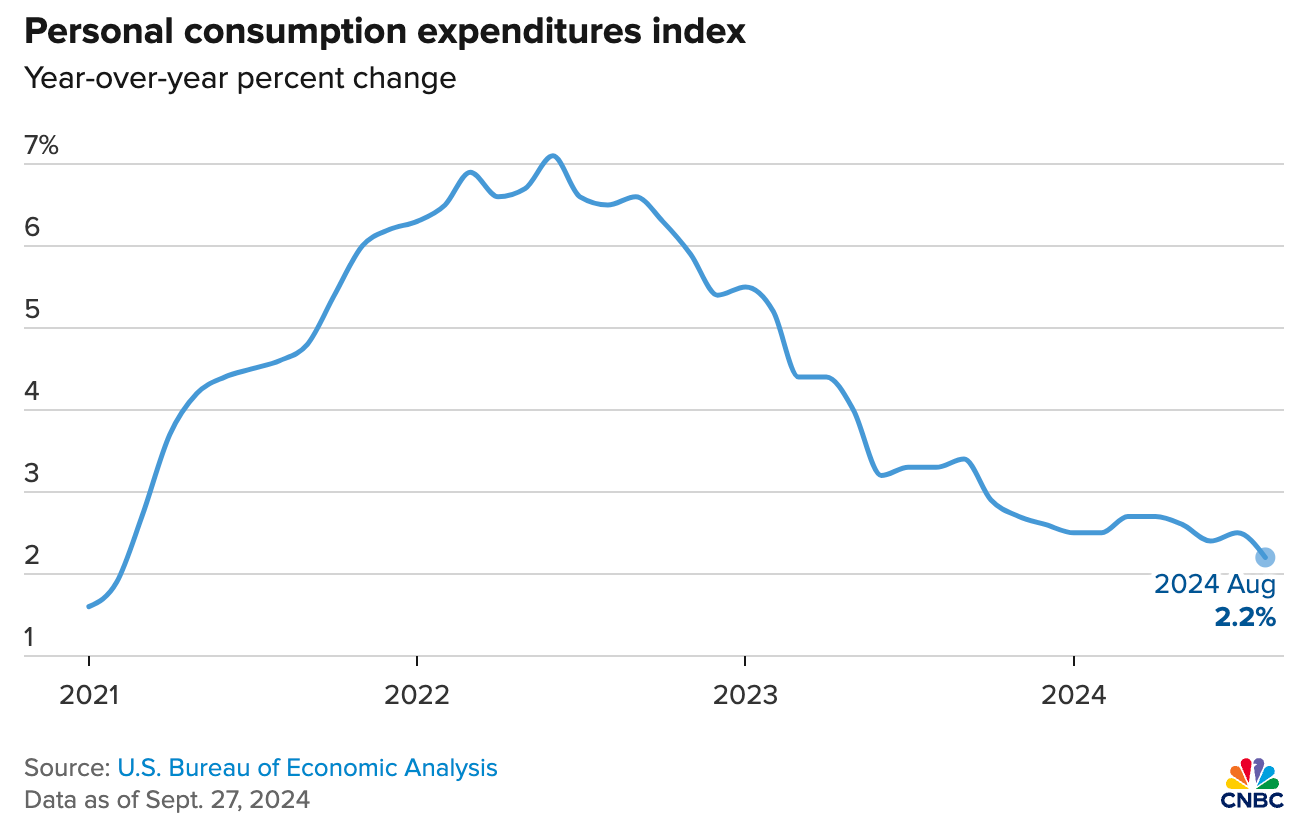

Of course, the recent Fed rate cut was great, although very much priced in as well, and U.S. inflation is finally trending down nicely, with the PCE price index, the Fed’s main measure, coming in at 2.2% over August, sitting below Wall Street projections, which is brilliant!

In addition, the Chinese government took significant measures to stimulate its economy, issuing $284B in debt, with the proceeds to be used as a $114 credit to families with more than two kids. The People’s Bank of China has also taken several measures to increase liquidity, including a 50 bps cut in the reserve requirement.

This is absolutely staggering and great news for those investing in China. The Hang Seng index has gained 25% over the last month, most of that coming from the most recent week.

Congrats, ya’ll. Take your profits and do not look back. Historically, this Chinese optimism never lasts long—the government generally ensures this.

Anyway, there is plenty of great news out there for investors. And yet, I remain skeptical and believe markets keep getting ahead of themselves, jumping on positive news headlines while mostly ignoring uncertain and often weak economic indicators and global geopolitical uncertainty.

Wall Street analysts and strategists also don’t seem to be able to make a decision, one moment predicting a hard landing as everyone panics, only to change their mind a few days later, now expecting a soft landing and fairytale scenario.

Honestly, it is hard to follow and absolutely pointless.

Now, this is just my quick take, don’t take this as any advice or prophecy, but currently, I remain careful. I am not a fan of timing the market and absolutely won’t, but I believe in buying at fair value and refuse to pick up shares at valuations that are too high for my taste.

Sadly, right now, a big part of the market has entered overvalued territory, at least in my view. Again, I believe markets are getting ahead of themselves, resulting in lofty valuations that do not leave any downside protection, which isn’t the most fantastic position to be in amid economic uncertainty and decade-high geopolitical tensions.

Not a premium subscriber yet, but you do want to keep reading? Alright, here is a one-time offer to become a premium subscriber at a 20% discount!