Starbucks Corp. – Amid turnaround hopes, is this the time to buy?

I'm just getting right to it: the answer is no. This is not the right time to buy Starbucks shares. Let me show you why!

The Q3 earnings season has kicked off again, and there is plenty of exciting stuff to discuss and examine! In case you missed it, my analysis of the following earnings reports have come out recently!

The Procter & Gamble Company – A brilliant business at a hefty price tag (Earnings Analysis)

Texas Instruments Inc. – An absolute gem in the semiconductor industry (A Deep Dive)

Lam Research Corp. – Now undervalued and poised for outperformance!

Uber Technologies – A brilliant business executing to perfection (Quarterly Update)

Introduction

I'm just getting right to it: the answer is no. In my opinion, this is not the right time to buy Starbucks shares.

Don’t get me wrong; I am still bullish on Starbucks’ long-term prospects. I believe the business still has a bright future thanks to its strong brand and the room to grow further through international expansion, market share gains, product innovation, and demand growth.

Furthermore, I am quite confident a turnaround can be realized here, especially under the lead of new CEO Brian Niccols, who has made a great first impression, and with Starbucks’ brand as strong as ever. As I have said before, the long-term thesis for Starbucks most certainly isn’t broken due to current macro headwinds and poor execution in recent years. Starbucks’ long-term growth potential remains significant, and thanks to its terrific brand image and popularity, it maintains a dominant position in the industry. This will all become apparent once more throughout this post.

There is plenty to like here still!

However, at the same time, I have serious trouble explaining the current share price and valuation levels amid a lot of uncertainty, Starbucks struggling significantly in the short term, prolonged weakness globally, a turnaround likely taking time, and current near-term analyst estimates still looking too optimistic, in my opinion.

In my view, the current share price and valuation levels are nowhere near sustainable, and as a result, I can see very little upside from current levels and expect more of a share price and valuation reset before there is room for more upside.

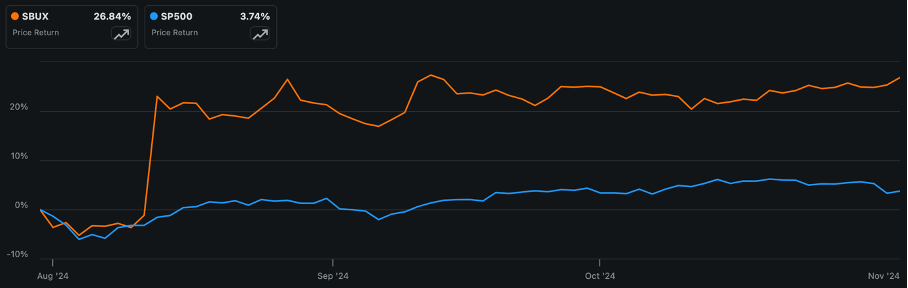

Whereas back in July, I really liked the valuation and felt like the weakness and expectations reset amid significant struggles for the business was well priced in, with the shares back then trading at just 22x earnings, shares have since bounced back nicely, gaining a whopping 27% in a span of three months.

Meanwhile, the business itself has experienced little improvement. Growth is slowing down further, headwinds remain apparent, and Starbucks looks a bit lost operationally, completely suspending its fiscal 2025 outlook and losing customers. In addition, the recently announced Q4 results showed a clear worsening compared to prior quarters and missed estimates across the board, with a bottom yet to form.

The single reason shares have performed as well as they did is thanks to the announcement of a CEO change with previous Chipotle CEO Brian Niccol coming in, and while definitely great news for investors, it just doesn’t justify a 27% higher share price by itself.

Yes, again, long-term, I remain confident, but it doesn’t justify buying at these levels and valuations amid quite a bit of uncertainty. Buying a turnaround story yet to materialize at a premium is not the way to go, in my humble opinion.

In the remainder of this post, I’ll dive into Starbucks’ fiscal Q4 results, recent developments, and the significance of the CEO change, updating my financial projections and targeted buying range.

Let’s delve in!

Is Brian Niccol really the difference-maker?

So, let’s start with the only good news from last quarter and the biggest difference maker for Starbucks shareholders—the single reason Starbucks shares gained $20 billion in value last quarter—the entry of a new CEO with quite a track record.

Indeed, back in August, Starbucks announced that CEO Laxman Narasimhan would step down after a tenure of just over a year to be replaced by Chipotle CEO Brian Niccol starting in September. In response, shares gained over 20% in a single day, marking the largest single-day gain for Starbucks shares since going public in 1992. This guy must be incredible, right?

Well, he kind of is, with a brilliant track record in the restaurant industry.

While Narasimhan needed 5 months of training to understand the industry and the company’s strategy, with no restaurant experience, Niccol has entered the company with 20 years as a leader in the restaurant industry.

Back in 2005, Niccol joined Procter & Gamble as vice president at Yum Brands. Later on, in 2007, he became chief marketing officer at Yum’s Pizza Hut brand and moved over to sister chain Taco Bell in 2011 to serve as chief marketing and innovation officer. After that, he became president from 2013 to 2015, already with many years of experience in the restaurant sector.

In 2018, Brian Niccol joined Chipotle as its CEO, where he has had incredible success over his 6-year tenure, expanding the business and growing Chipotle into one of the biggest restaurant chains in the U.S. – Chipotle shares lost as much as 13% on the news of Niccol’s departure in September.

In his tenure at the company, Chipotle’s share price rose 770%, saw just a single quarter of negative same-store sales (during Covid), and restaurant-level margins expanded from 19% in 2018 to 29% in his last full quarter.

Even as the company faced a very tough food safety crisis, Niccol quickly turned the narrative around, leveraging his marketing background to create cultural and menu relevancy at the chain. In addition, through his expertise in digital technologies, the company was able to limit the COVID-19 impact on the business, with digital sales becoming a large portion of the company’s revenues, sitting at 40% today.

In other words, Niccol has executed close to perfection in his 6 years at Chipotle, navigating the business successfully in challenging and good times, turning it into one of the most exciting and fast-growing restaurant chains in the U.S.

Clearly, Brian has a proven track record when it comes to leveraging a popular brand and growing the restaurant business in all the right directions, as well as plenty of experience with negating a crisis and realizing a successful turnaround.

I guess that explains investor enthusiasm once he was announced as the new Starbucks CEO. If one guy can turn this business around, it should be Brian Niccol. This is, indeed, a difference-maker. I genuinely believe Niccol's appointment significantly raises the chance of a successful turnaround here and rightfully increases investor confidence.

I am definitely a big fan and believe this was the best possible move for Starbucks. Furthermore, based on the first disclosed information of his turnaround plan, Niccol already seems to be on the right track, looking to develop the business in all the right directions, and with the 2025 outlook suspended, the new CEO is given a clean slate to work his magic.

But more on that in a bit. Let’s first delve into the fiscal Q4 results to see how the business is doing right now.

Warning: It is quite bad…

Is this a kitchen sink quarter? Let’s hope so…

Last week, Starbucks officially released its full fiscal Q4 results after already issuing preliminary results one week before, warning investors the company’s performance was worse than anticipated. This allowed Starbucks to focus the earnings call last week on the turnaround story and Brian Niccol’s plan.

Indeed, the Q4 results were rather bad, with fundamentals and financials weakening further across the board. The results very clearly reflected continued traffic challenges for Starbucks, resulting in pressures throughout the company's Q4 results, from top to bottom line.

Positively, I should say the earnings call gave me kitchen-sink vibes. Management seemingly put everything out there to create an environment with low estimates and room to outperform, even fully suspending 2025 guidance. This could be a positive going forward, though I am not too optimistic in the near term.

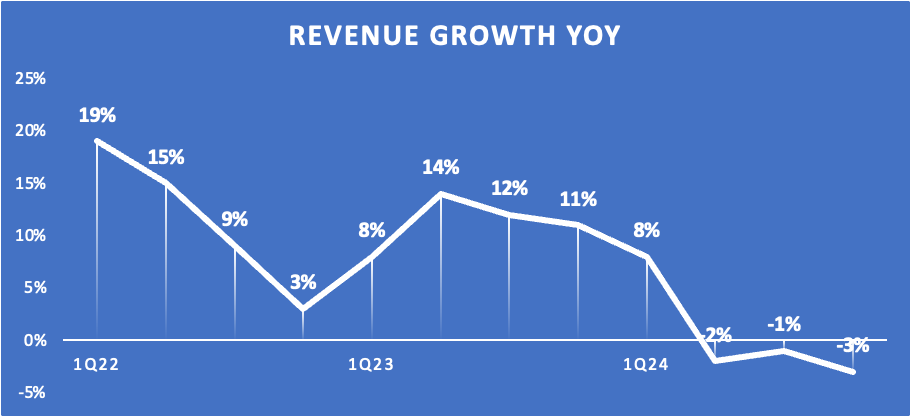

Starting with last quarter’s top-line performance, revenue came in at $9.1 billion, roughly in line with the consensus estimates and down 3% YoY, which is a further growth decline after -2% and -1% in the previous two quarters, showing Starbucks continues to struggle.

The revenue decline was mostly driven by a 7% decline in comparable store sales or actual growth, leaving new store additions out of the question, and that is just a straight-up weak performance, worsening from -3% and -4% in the previous two quarters.

Once again, poor traffic or customer numbers were the biggest drivers of this decline, as the number of transactions or purchases declined 8% YoY in fiscal Q4. Clearly, Starbucks is still facing very soft demand and seems unable to attract customers with discounts or seasonal product excitement.

Especially in the U.S., weakness was pronounced with a 6% decline in comparable store sales, driven by a whopping 10% decline in comparable transactions, which was way weaker than anticipated.

Now, at least in part, this can be attributed to poor consumer confidence and spending. Still, we can’t leave out that Starbucks is also simply unable to attract consumers to its cafe’s amid high prices, complicated menus, and limited room for seating. Starbucks seems to have moved away from its core strategy and is creating a distance from its core customer base, which is highlighted by a decline in loyalty member purchases.

Also, while active Starbucks Reward membership grew 4% year-over-year to 33.8 million, it remained flat compared to last quarter, and YoY growth continues to slow down significantly.

This is how management put it:

“Traffic declined across all channels and day parts, with the most pronounced decline in the afternoon day part. In addition to the continued decline of non Starbucks rewards member visits, frequency also slowed across all SR member deciles in comparison to prior year and ultimately impacted spend.

Offerings as well as promotions did not create sustained excitement or the stickiness we planned.”

A pretty clear message that is from management.

Positively, some of this traffic weakness was offset by a 2% increase in average tickets (4% in the U.S.). However, this wasn’t due to larger purchases but rather due to price increases, which also isn’t sustainable. Weakness was further offset by 7% YoY growth in the number of stores.

Starbucks also continues to struggle significantly in China due to intensified competition and a very soft macro environment still impacting consumer spending. As a result, Starbucks reported a 14% YoY decline in comparable store sales, driven by a 6% decline in transactions and an 8% decline in average tickets, coming from elevated discounting.

Starbucks is struggling significantly across the board…

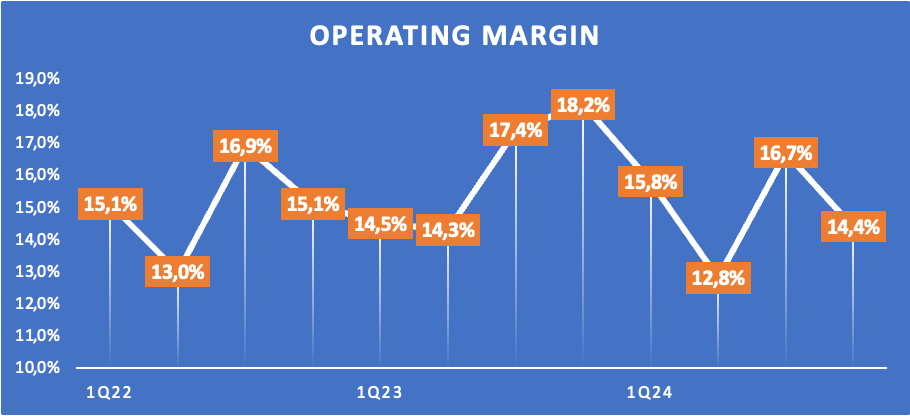

Moving to the bottom line, the performance wasn’t much better. Starbucks reported an operating margin of 14.4%, down 370 bps YoY, driven by deleverage, investments in store partner wages and benefits, and increased promotional activities. These factors were partially offset by pricing and the in-store operational efficiencies, which provided a 150 bps tailwind.

Nevertheless, the margin performance wasn’t great. This led to Q4 EPS of $0.80, down 24% YoY, driven by a combination of top-line weakness and heightened investments.

Cash flows declined across the board, and as a result, the company’s total cash balance and short-term investments also dropped further to just $3.5 billion, which doesn’t compare favorably to a total debt approaching $26 billion. This translates into a net debt on the balance sheet of $22.5 billion, compared to $17 billion at the end of 2021.

That is not a great development, even as the company maintains a BBB+ credit rating.

Meanwhile, the company does remain committed to its dividend, which might be somewhat of a comfort to investors. Last quarter, the company announced a 7% increase in its quarterly cash dividend, marking the 14th consecutive increase.

Investors now receive a relatively juicy 2.5% yield, growing at a high single-digit CAGR. It's not too shabby, although this is currently based on a 70% payout ratio based on depressed EPS levels. Once EPS normalizes a bit, this should drop to below 50%, which is quite healthy, in my opinion.

Ultimately, Starbucks is showing significant weakness across the board, from top to bottom line, with little visibility on a recovery and a bottom yet to form. At this time, there is very little to be optimistic about when it comes to the business and financial performance.

On that note, let’s look at Brian Niccol’s turnaround plan, which he elaborated on a bit more during the earnings call.

Let’s turn to the positives, shall we?

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Brian Niccol is on the right track with his turnaround strategy!

As highlighted by the fiscal Q4 results, Starbucks’ weaknesses and issues go deeper than just macro headwinds. In the words of Brian Niccol, “The financial results were very disappointing, and it is clear Starbucks needs to fundamentally change its strategy to win back customers and return to growth.”

You see, in recent years, the company has been slowly moving away from its core strategy and identity, removing seating areas in its café, adding food and other beverages to its menu, and focusing on digital and loyal customers over general traffic.

The result of this shift? Wait times have increased too much, in-store seating has worsened significantly, quality and consistency have worsened, and the overall customer experience has suffered. Instead of improving the customer experience, changes in recent years have only deteriorated the experience, and Starbucks has been making it harder for customers to get a simple coffee.

Unsurprisingly, this has translated into a worse customer experience, which Niccol identified as Starbucks' biggest issue and the driver of poor traffic. I can only agree.

Positively, all these issues are fixable and within management’s control, making it possible for Niccol and Co. to turn the ship around.

In order to do this, Niccol simply wants Starbucks to return to its core identity, with the goal of making it a joy again to visit a Starbucks location, which he believes will go a long way in improving traffic. This is how Niccol himself put it:

“As I mentioned last week, success comes from staying true to your identity, taking care of customers and your team, simplifying the business, delivering consistently high-quality products and experiences, and telling your story.”

With a brand as strong as Starbucks', indeed, no massive or complicated changes or reorganizations need to be made, and Niccol seems to realize this very well.

Summarizing all the points he has discussed in recent times, Niccol simply wants to improve the customer experience by returning Starbucks to its core identity, with it once again being the so-called “third place” – a concept that refers to creating an environment that serves as a social space distinct from the "first place" (home) and the "second place" (work) - a place to meet, people, socialize, work, and drink great coffee.

Niccol wants the company to embrace this identity and strategy once more, with which Starbucks has previously become a huge success.

In terms of efforts to realize this, a few have stood out to me. First of all, Starbucks will start focusing on straightforward pricing while still maintaining plenty of customization ability, timely service, consistency, and an enjoyable experience.

This includes the goal of delivering each drink in under 4 minutes, well below the current average of 8 minutes, which is just way too long and massively impacts user experience. To support this, management intends to further scale its investment in Siren equipment, which should improve speed and efficiency in its stores.

Furthermore, the company will reduce new café openings and renovations in 2025, as management will take its time to accommodate a redesign and free up capital.

As for café improvements, management is committed to reintroducing more personal touches to elevate the cafe experience and will eventually bring back more comfortable seating in most locations to ensure stores are places where customers want to sit, work, and meet, as intended.

Honestly, speaking from my own experience, I believe this is a critical step.

In addition, Niccol plans to fix the overly complex and extensive menus to improve throughput quality and consistency. While still offering plenty of choices, management wants to stay true to its identity as a coffee company, focusing on fewer but better offerings. And considering Niccol’s commitment to technology, I bet digital menus will be a part of this.

Other small details management intends to improve include a better algorithm to assign digital orders to avoid an overflow of these, which often occurs at busy locations, impacting completion times. Again, the goal is to improve the customer experience.

In another effort to please customers and improve traffic, management also committed to not increasing menu prices at all in its company-operated stores in North America through the end of fiscal 2025, which should help with traffic numbers.

At the same time, it will also reduce the frequency of discounts, as they have proven ineffective and only dilute the company’s premium positioning, which it intends to maintain, helped by a far better café experience and higher quality drinks.

Recently, Starbucks’ pricing has occured as a big negative for consumers and rightfully so. These are simply unwilling to pay a premium for an average experience. However, once this in-store experience and quality improves, I don’t doubt consumers will once more be willing to pay a premium for this.

Now, of course, this will be a multi-year plan, and it will take some time to make the necessary changes, identify further issues, and come up with solutions. It is unreasonable to expect changes to be made overnight and a successful turnaround to be realized in the blink of an eye.

Also, for now, Niccol is fully focused on getting the North American operations functioning properly again, not yet looking for solutions for the company’s crucial China business, saying he needs to spend more time in China to better understand the company’s operations and the market before deciding how to revive sales there.

However, with all we know today, I am pleased with Niccol’s early efforts and plans to turn this business around. I genuinely believe returning Starbucks to its core identity and focusing on consistency, quality, and the user experience is the best way to go.

I am optimistic, although simultaneously cautious, and await the first positive signs that management’s efforts are paying off.

Patience will be key here for investors as it will take time.

Outlook & Valuation

Turning to the outlook, the most notable development has been management’s decision to suspend its fiscal FY25 guidance, giving new CEO Brian Niccol a clean slate to assess the state of the business in more detail and implement certain initial changes.

So, what can we expect in the near and medium term?

In the short term, I expect Starbucks to keep struggling significantly, although I do not anticipate a further worsening in top-line growth from current levels and a bottom to form sooner rather than later. Global economic weakness is expected to persist, which will weigh on Starbucks's traffic. Also, initial efforts like the absence of price increases in North America and less new store openings could put additional pressure on near-term growth. I anticipate management’s recent efforts and plans to not show too much result until at least the second half of the 2025 fiscal year.

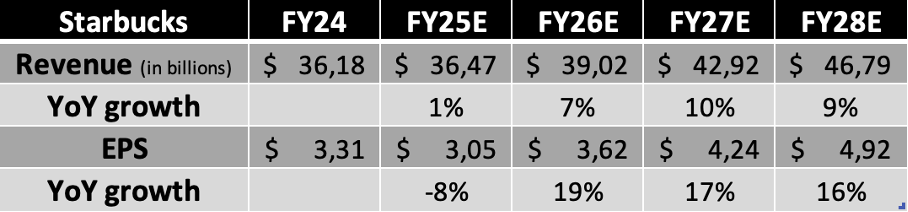

All things considered, I remain cautious about Starbucks’ short-term performance as I anticipate headwinds to remain. Therefore, I believe the current consensus, pointing to some 3.5% revenue growth, might still be too optimistic. Personally, I anticipate revenue to remain largely flat YoY, with margins likely to decline further amid strategic investments and depressed revenue levels.

In the medium term, I believe there is room for some optimism as economic pressures ease, and the Fed’s current rate cutting cycle should positively impact consumer spending as we enter the second half of the calendar year 2025. In addition, I trust management will be able to revitalize the business gradually throughout the years ahead, although I do believe a recovery for Starbucks will be somewhat slow. Positively, bottom line growth after the current fiscal year should be more aggressive.

Overall, the recovery will likely be gradual, in line with current analyst estimates, although, again, I do anticipate slightly lower financial results as Wall Street seems to be slightly too optimistic at this time.

Ultimately, I now project the following financial results through fiscal FY28.

After the expectations reset and the 27% share price pop over recent months, shares have gotten rather expensive. Using my EPS expectations above, shares now trade at 32.5x this year’s earnings and 27x next fiscal year’s earnings, which is a hefty premium to pay for a turnaround story yet to materialize. I mean, it has barely started, and the business is performing exceptionally poorly right now, with poor visibility on a recovery.

Furthermore, on an Enterprise Value to Earnings basis (EV/E), we are now looking at a 32.5x multiple, which is relatively rich once again. Finally, using a PEG ratio that better reflects the earnings growth ahead, we end up with a multiple of around 1.9, which is far more reasonable at a 23% discount compared to the 5-year average. However, that is against a far more uncertain narrative and still a 22% premium to the sector, which it arguably no longer deserves.

Long story short, after the great performance of the share price in recent months, Starbucks shares have become far too expensive to buy into this turnaround story.

I don’t believe that a current share price of $99 presents a compelling opportunity at all, with limited downside protection and very little room for outperformance in the longer term.

For reference, using my fiscal FY27 EPS estimate and a much more reasonable and still rather optimistic 26x long-term multiple, I calculate a target price of $110, translating into potential annual returns (CAGR) of just 3.5%. Obviously, this is nowhere near sufficient to warrant a buy rating.

Ultimately, I am on the sidelines right now.

However, on any significant weakness, I will be a happy buyer of shares as I really dig Brian Niccol and his laid-out strategy and believe a turnaround is a matter of time.

Personally, I am now aiming to pick up more shares at prices below $85 per share, as I believe this would offer sufficient potential returns and far better downside protection.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.