Uber Technologies – Shares remain cheap, with potential for a 17% return CAGR

After a 37% rally YTD, are Uber shares still worth buying? The answer is YES!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Earlier this week, Uber released its first quarter results, which didn’t entirely meet the consensus estimates, leading to some initial disappointment. As a result, shares lost a few percentage points in the following trading session and were down roughly 3% for the week.

However, I will argue that Uber actually delivered an excellent quarterly report, showing no fundamental operational or demand weakness, even as the operating environment becomes more complicated amid trade wars and a rising risk of a recession. Uber continues to execute very strongly on all fronts. It reports strong numbers with healthy underlying drivers. MAPC (user) growth was strong, engagement grew, and cash flows and margins continue to improve above expectations.

Yes, Uber reported revenue that fell marginally short of expectations, but this is absolutely no reason for concern, and there is certainly no real reason to justify a minor sell-off.

At the same time, it is worth noting that Uber shares have skyrocketed over the last month, gaining over 20% and remaining up nearly 40% year-to-date. With shares now back over $80 and close to an all-time high, they have seemingly exited the deep value territory. Nevertheless, they remain relatively attractive, considering Uber’s long runway of growth, its massive market dominance, and rapid cash flow improvements.

However, more details on the outlook will be provided later. Let me first delve deeper into the Q1 results, breaking them down and putting the numbers into perspective.

I remain incredibly bullish. Uber is still my largest position. Let me show you why!

Q1 results + highlights

Gross Bookings were up 18% YoY to $42.8 billion in constant currency (14% including FX headwinds from a strengthening dollar).

Revenue grew 14% YoY to $11.5 billion, or 17% on a constant currency basis.

Despite economic headwinds and concerns over consumer health and spending, Uber delivered an excellent quarterly report. The company delivered healthy gross bookings growth of 18% YoY (I use FX-neutral numbers for a fair representation of performance), down slightly from previous quarters. This was as expected, with the company lapping last year’s strong performance and slowly but surely facing the rule of large numbers.

Still, at its massive base, delivering high-teens gross booking growth is still very impressive and a remarkable feat.

Supporting this strong gross bookings performance was continued growth in both users and engagement, the two big growth drivers for Uber.

Remarkably, MAPCs (Monthly Active Consumers) grew strongly again, increasing 14% year-over-year (YoY) to a whopping 170 million, remaining mostly stable from the previous quarters. This is helped by retention rates at all-time highs, Uber’s continued expansion into more countries and cities, and Uber’s increasingly important role in people’s lives.

This is nothing short of impressive to me. Growing users at a stable mid-teens rate, with a 170 million existing customer base, is brilliant, with Uber seemingly not facing any size headwinds.

Meanwhile, this still represents only about 5% of the adult population in Uber’s current markets, leaving ample room for growth.

In addition to this growth in users, Uber also continues to report stable growth in engagement, with monthly trips per MAPC increasing by 3% year-over-year in Q1. So, Uber is not only growing the number of consumers using its platforms, but each of these consumers is also using the platform more frequently.

This led to strong growth in total trips in Q1, up 18% YoY, showing a stable performance from recent quarters and absolutely no demand weakness.

Ultimately, this strong underlying performance led to solid revenue growth of 17% year-over-year (14% excluding currency headwinds). This was slightly below gross bookings growth due to the impact of fluctuations in geographic mix.

As shown below, this reflects a further slowdown in revenue growth from the previous quarter; however, this can be attributed mainly to currency fluctuations. For reference, FX was a $1.7 billion headwind on gross bookings in Q1, pressuring YoY growth by 4.5 percentage points, driven by a weak dollar.

This is also having a considerable impact on revenue, so I believe that all things considered, revenue growth remains solid.

Breaking this all down a bit further, let’s focus on the performance by section, starting with mobility.

Mobility gross bookings increased by 20% year-over-year in constant currency, driven by a 19% rise in trips, primarily due to strong growth in users and engagement. Notably, this includes a minimal effect from rising prices, as Uber is able to absorb significant rising costs (such as insurance costs), which keeps user growth healthy, as well as driver satisfaction.

Notably, this also led to solid growth in active drivers, reaching a record high of 8.5 million, a 20% year-over-year increase. With driver growth still outpacing trip growth, Uber’s marketplace health continues to improve, leading to lower driver incentives and a higher take rate.

Overall, Uber’s mobility segment continues to perform strongly.

The same can be said about the delivery segment, which appears to be performing even better, relatively speaking. Delivery gross bookings in Q1 were up 18% YoY in constant currency, showing a mostly steady performance over the last 1.5 years, even accelerating slightly, as Uber’s delivery operations remain healthy and best-in-class.

Following a deceleration in growth post-COVID, growth has been accelerating steadily, as shown above, supported by a market-leading position and rapid expansion into new delivery channels, such as grocery and retail, which alone is now good for $10 billion in annualized gross bookings, even as only 18% of delivery users order grocery and retail products monthly. Supported by this, Uber now fulfills over 2 billion orders in roughly 30 countries each quarter, and leads in 8 out of its top 10 markets.

In delivery, similar to mobility, Uber enjoys significant scale advantages due to the relatively low industry profitability and numerous competitors. However, thanks to its size, Uber’s delivery operations are now solidly profitable, and the company continues to gain market share in all its leading markets, thanks to an acquisition, engagement, and retention advantage.

Similar to Uber’s mobility operation, its delivery operation remains very healthy.

In addition to these excellent operations, the company’s advertising efforts are also developing really well, now reaching a $1.5 billion annual run-rate, up 60% year-over-year. These are excellent, high-margin, fast-growing revenues, contributing significantly to margins.

On that note, let’s move on to the bottom-line results.

Q1 adjusted EBITDA was $1.9 billion, up 35% YoY.

FCF was $2.3 billion, reflecting an FCF margin of 20%.

On the bottom line, Uber continues to impress with rapidly expanding margins. EBITDA hit a record high of $1.9 billion in Q1, up 35% YoY and reflecting a 16.5% EBITDA margin, up 160 bps YoY and 110 bps sequentially, showing great progress amid growing operating leverage and lower spend.

Further down the line, Uber reported a GAAP operating income of $1.2 billion, up from just $172 million one year ago. This rapid increase was driven by strong top-line growth, fewer discrete legal and regulatory matters, and lower stock-based compensation expense.

This resulted in a net income of $1.8 billion, or an EPS of $0.83, which exceeded estimates by $0.33, or over 50%. Notably, this included only a minor $51 million contribution from Uber’s equity stakes.

All the way down the line, this resulted in an FCF of $2.3 billion or a TTM FCF of $7.8 billion, reflecting a conversion of 112%. Uber’s earnings power is impressive and improving rapidly nowadays.

These strong cash flows enabled it to maintain a healthy balance sheet, with $6 billion in cash and $8.7 billion in equity stakes, against $11.1 billion in debt. This leaves Uber with plenty of liquidity.

And Uber is using it. In Q1, the company acquired a controlling stake in Trendyol’s leading food delivery and grocery service, Trendyol GO, for approximately $700 million in cash. The company is a market leader in the Turkish market, which is one of Uber’s largest untapped delivery markets, only behind Brazil and India. The controlling stake makes a lot of sense, and I like management’s aggressive approach.

Additionally, Uber continues to utilize its cash reserves and strong free cash flow generation to repurchase its own shares. In Q1 alone, management repurchased $1.8 billion of its own shares under its $7 billion authorization, with $4 billion remaining. With Uber shares still cheaply priced, I believe this is an excellent use of cash.

All in all, this makes for an excellent quarter for Uber, with healthy numbers across the board and no significant weaknesses evident.

Uber makes progress toward its autonomous vehicle vision.

Now, I addressed this subject in much more detail in my last post (found below), so I will not repeat myself today. However, I do want to highlight some of the developments from last quarter in this area.

Uber continues to make solid progress on its AV vision. By now, the company, through numerous AV partnerships, realizes 1.5 million AV trips annually. Last quarter, the company launched Waymo exclusively on its platform in Austin, with great success. In the months ahead, a similar deal will launch in Atlanta.

Meanwhile, in recent weeks, the company has expanded its total to 18 AV partnerships, including an exclusive deal with Volkswagen to deploy its fully autonomous vehicles on its platform, with testing set to begin in Los Angeles later this year. Additionally, the company signed a deal with Avride for deployment in Dallas and an expansion deal with WeRide for an additional 15 cities over the next five years.

Not too much more to elaborate on right now, but Uber is executing its strategy nicely and remains the best positioned to benefit from the AV revolution, thanks to its dominant platform and brand.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3-7 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and ratings, and even more!

This includes immediate access to recent premium posts like:

Outlook & Valuation

Q2 gross bookings to be between $45.75 billion and $47.25 billion, reflecting 15% YoY growth (16% to 20% on constant currency)

Q2 adjusted EBITDA to be between $2.02 billion and $2.12 billion, reflecting 29% to 35% YoY growth.

This outlook reflects a likely stabilization in FX-neutral gross bookings growth in the high-teens, also reflecting an expectation for stable demand. Meanwhile, the outlook points to continued margin expansion and rapidly growing cash flows.

This is a solid outlook, roughly in line with expectations.

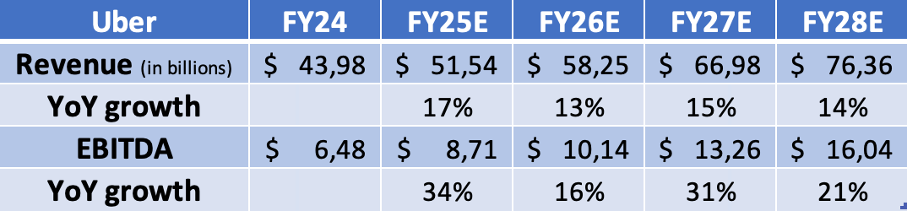

Following the Q1 results and management’s Q2 guidance, I have meaningfully raised my FY25 financial estimates. Despite the Q1 miss, I have slightly raised my revenue projection for this year. Meanwhile, following a very strong Q1 EBITDA margin, I have raised my FY25 EBITDA margin estimate from 16.2% to 16.9%, resulting in a significantly better EBITDA outcome.

At the same time, I have slightly trimmed my FY26 estimate to account for some potential economic weakness and a rise in U.S. unemployment. Finally, my estimates for 2027 and 2028 are mostly the same. This all results in the following projections.

Now, with shares up a whopping 37% YTD, one might assume Uber shares have moved out of value territory. However, that is a wrong assumption. Even at a current price of roughly $83 per share, Uber remains a deep value pick.

Based on the projections above, Uber shares now trade at just under 20 times this year’s EBITDA, which is essentially flat from three months ago, as the consensus has also increased considerably. Furthermore, even though EPS may not be the best representation here, we are still looking at a forward PEG of just 0.81x. Sitting well below 1x, this puts Uber shares in deep value territory, simple as that.

Therefore, at current prices, I will still happily argue that Uber shares remain extremely attractive and quite a bargain, with investors still failing to price in Uber’s moat, favorable long-term positioning, and brilliant outlook.

If we assume a long-term 20x EBITDA multiple, which is more than fair, I calculate a target price of $127 per share. From a current price of $83, this represents potential returns of 17% annually, which should easily beat global benchmarks.

These remain excellent potential returns and reflect a very favorable risk-reward ratio, with plenty of downside protection, although I doubt we’ll need it.

Ultimately, Uber continues to execute brilliantly, and at current prices, I reaffirm my Buy rating – I will keep buying.

I’ve added a couple shares around 62$ this year. Now a full position around 7% for me.

Value is everywhere, I found it hard to believe uber could be it at first. However $ earned from a ride share is equal to $ earn from selling oil in my book.