Weekly Insight #7 – Last week was a crucial expectation reset

In this week's Insights post, we dive into last week's CPI and whole prices reports, and some other notable developments.

Finally! Investors, traders, and the market as a whole finally came to the realization that the priced-in rate cut expectations were too optimistic. A hot CPI report on Wednesday and more inflation-related data on Friday caused a reset in expectations on Wall Street, which led to the first red week in a while for U.S. indices, even as Q4 earnings remained solid.

Over the week, the Dow eventually ended only marginally lower by 0.11%, followed by the S&P500, which was down 0.42%, and the Nasdaq, down 1.42%. Indeed, these are still no massive pullbacks as sentiment across Wall Street remains positive across the board, still driven by strong and better-than-expected Q4 earnings and solid economic data.

However, crucially, the rate cut expectations have been reset and look more realistic, which makes current gains and all-time highs at least somewhat more durable. By saying this, I mean that more realistic expectations translate to lower volatility and less risk of more downside due to bad news. As a result, we are slightly more optimistic about the market’s risk-reward, even if the drop was marginal. Though, this does not mean we are actively buying and our expectations for 2024 remain unchanged.

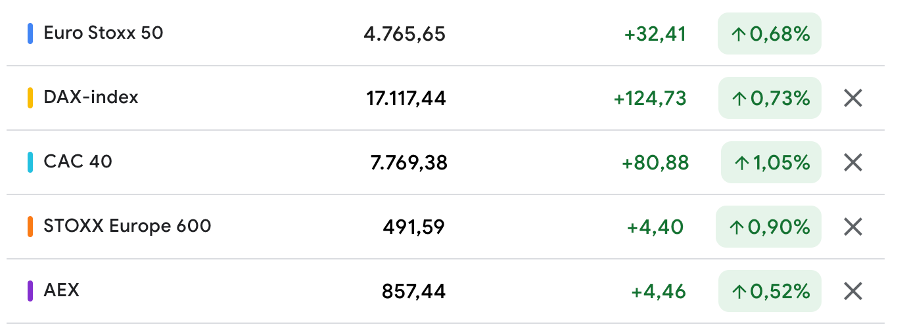

As for the European markets, these performed slightly better last week, with the largest indices all up by 0.5% to 1%, actually making it one of the better weeks so far this year.

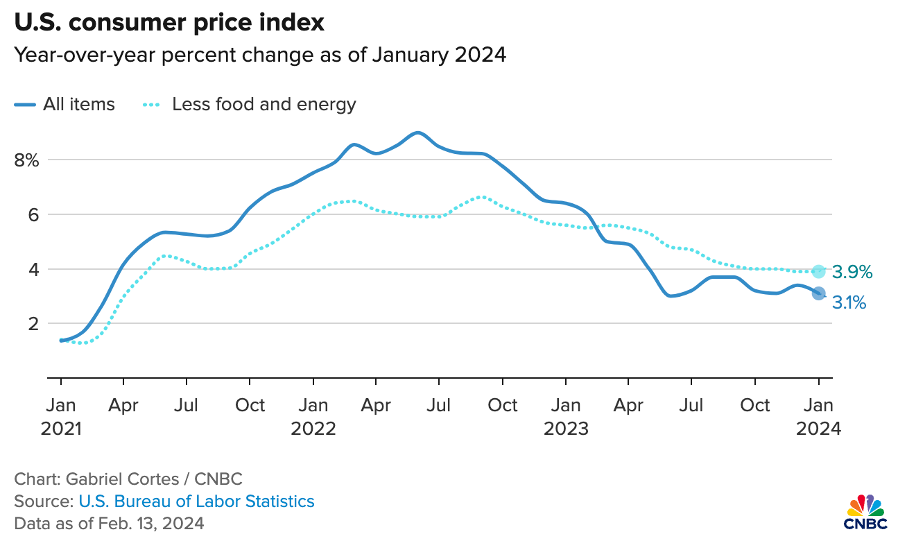

To get deeper into last week’s economic and market developments, let’s start with the week’s headline, the CPI report. U.S. inflation in January was up more than expected as stubbornly high shelter prices weighed on consumers, according to the latest report. The CPI (consumer price index) was up 0.3% in January, up from 0.2% reported in the prior two months. Furthermore, on a 12-month basis, this was up 3.1%, down from 3.4% in December. Meanwhile, economists surveyed by Dow Jones predicted a 0.2% increase in January or 2.9% over the last 12 months.

Shelter prices accounted for a third of the rise as these were up 6% on a 12-month basis. Also, inflation-adjusted hourly earnings increased by 0.3% in December, creating a very unfavorable report for the Fed, which is looking for inflation to trend down much stronger toward the 2% target and for wage growth to ease.

As a result, markets fell sharply in response to the CPI report, with the Dow down by 500 points or close to 1.5%, making it the worst day in almost a year. Moreover, the S&P500 and Nasdaq were down closer to 2% as the market was finally forced to price in lower rate cuts in 2024, as this January CPI report is problematic for the central bank, in line with our expectations. This is what Quincy Krosby, chief global strategist at LPL Financial, said with regard to this:

“The much-anticipated CPI report is a disappointment for those who expected inflation to edge lower, allowing the Fed to begin easing rates sooner rather than later. Across the board, numbers were hotter than expected, making certain that the Fed will need more data before initiating a rate cutting cycle.”

Solidifying this even more was the fact that core inflation, which officials believe is a better guide of long-run trends as it excludes volatile food and energy prices, was even more stubborn. This came in at 0.4% in January and 3.9% on a 12-month basis, similar to December, showing little progress.

Clearly, and as we have been saying many times by now over the last 1.5 months, inflation is not coming down as fast as the market was expecting, and this reset in rate cut expectations was a matter of time. The simple fact is that current inflation levels and trends do not warrant the Fed to start cutting rates.

Meanwhile, our basis scenario remains a first-rate cut in June, but this will demand inflation trends to improve in February. Otherwise, we might have to wait for a first-rate cut to appear in the year's second half, an opinion shared by Peter Cardillo, chief market economist at Spartan Capital Securities. He said the following:

“It’s a hotter-than-expected report, and it’s part of what the Fed has been alluding to when it says it’s too early to say that inflation has been beaten. If this keeps up with another month or two of inflation staying high, you can kiss a June (rate cut) goodbye, and we’re probably looking at September.”

The hotter-than-expected CPI report was backed up on Friday by another inflation-related report. The Labor Department reported on Friday that wholesale prices rose more than expected in January, further adding to a complicated inflation trajectory. As reported by CNBC, “The producer price index, a measure of prices received by producers of domestic goods and services, rose 0.3% for the month, the biggest move since August. Economists surveyed by Dow Jones had been looking for an increase of just 0.1%. PPI fell 0.2% in December.”

Core PPI, which excludes food and energy, was also up 0.5% against an expectation for a 0.1% gain, which is quite a significant miss. Moreover, PPI, excluding food, energy, and trade services, was up 0.6%, which was the most significant monthly advance since January last year. Clearly, inflation is more sticky than many anticipated, further adding to the expectations for a higher for longer interest rate environment. In response to this data, markets fell by another 0.5% to 1% on Friday.

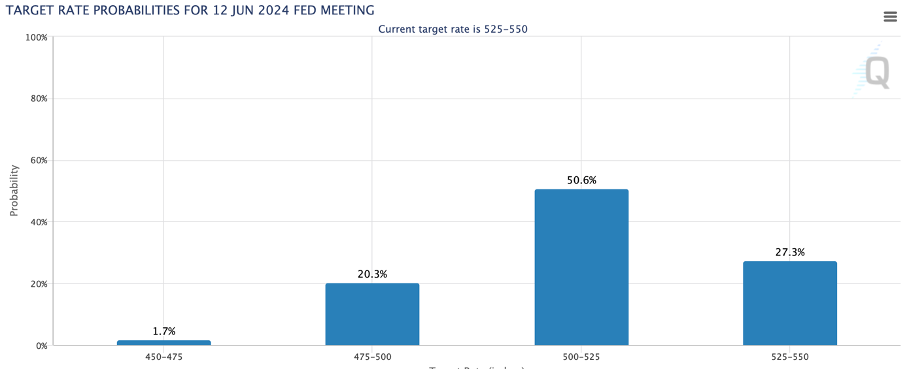

Positively, after last week’s expectations reset, the market is already anticipating the possibility of a first rate cut as late as the second half of the year. Looking at the projections from CME Group, we can see quite a shift here from last week. Whereas at the start of the week, the market still priced in a 52% likelihood of a 25 bps rate cut in May, this has now fallen to just 31%. The market now counts on the Fed to keep rates flat in both the March and May meetings and isn’t even convinced of a cut in June, as visible below.

Clearly, the market is no longer as optimistic about the rate cut roadmap as it was before, as sentiment was hurt by the hot CPI report on Wednesday, which is very much a good thing! The current rate cut trajectory the market is counting on is much more realistic, which means less optimism is now priced in after a reset on Wednesday.

However, the market quickly recovered those losses the day after as relative optimism remains, driven by solid earnings and impressive economic resilience. This is what we wrote last week:

“These new all-time highs, market gains, and investor optimism are driven by better-than-expected Q4 earnings, solid guidance, and healthy economic growth. All these factors have so far been able to offset the headwinds mentioned before, which is great but, at the same time, also makes this optimism rather sensitive to bad news.”

Overall, not much has changed for us following this CPI report. We remain of the opinion that a June rate cut is still most likely, and markets continue to be fueled by optimism. I'd like to point out that caution is still advised as volatility will remain, especially by the start of Q2.

Now, besides the CPI report, last week’s economic data also included the weekly initial jobless claims report, which once more showed a number below expectations, pointing to a resilient labor market. Initial jobless claims for the week ended February 10 were 212,000, which is down by 8,000 from the prior week. Not much of a surprise there, as the U.S. labor market remains resilient.

On another negative note (or positive, it is hard to keep up), consumer spending dropped far more than expected in January. Whereas economists were looking for a 0.3% contraction, retail sales fell by a much more significant 0.8%, according to the Census Bureau. Even excluding car sales, sales dropped 0.6%, well below the estimate for a 0.2% gain.

Crucially, this could potentially be an early sign of a weakening economy while also being a potential positive for the Fed, making it a positive and a negative at the same time. However, as pointed out by Robert Frick, corporate economist for Navy Federal Credit Union, “December was high due to holiday shopping, and January saw drops in those spending categories, plus frigid weather plus an unfavorable seasonal adjustment. Consumer spending likely won’t be great this year, but with real wage gains and increasing employment, it should be plenty to help keep the economy expanding.”

For now, this report is not much of an indicator. An improved reading in February is most likely offsetting a weak January. At this point, it's fair to say the market is balancing the good and bad news and has to decide meanwhile whether something is good or bad news… if that even makes sense.

Meanwhile, however, European economies are also struggling, with Germany’s economy on shaky ground and the UK GDP numbers pointing to a recession. The German economy, one of Europe’s largest and its industrial heart, has not seen much good news in recent weeks.

Key numbers such as factory orders, exports, and industrial production, which came out last week, indicate that there is little improvement and not yet any sort of recovery for the German economy. In December, industrial production was down 1.6% sequentially. Furthermore, exports were down 4.6% in December and 1.4% for the full year.

While this sure isn’t great, the most recent Purchasing Managers’ Index report, which showed an 11-month high, was a highlight, indicating that the worst might be over.

Nevertheless, after two consecutive quarters of negative economic growth, the German economy remains in a recession. Data from the Federal Statistics Office showed that the German economy contracted by 0.3% in 2023, and analysts aren’t optimistic about 2024 either. Currently, Commerzbank analysts led by Chief Economist Jörg Krämer expect another year of GDP contraction in 2024, estimated at a shrinkage of 0.3%—all in all, not a pretty picture for arguably the most important European economy.

In other news…

PepsiCo defended by Wall Street – Coca-Cola performs better

PepsiCo reported Q4 earnings on February 9 and missed the consensus, disappointing investors, which led to the share price falling by a couple of percentage points. The company reported organic sales growth of 4.5% for the quarter, which missed the 5.9% consensus. This led to a 0.5% decline in revenue to $27.9 billion.

Volumes continued to weaken as consumers were still processing last year’s price increases. Meanwhile, price increases eased, which led to the unfavorable comparison. On top of this, PepsiCo’s guidance also fell short of expectations as the company now guides for 4% organic growth in 2024 and 8% core constant currency EPS growth.

Nevertheless, Wall Street analysts defended the food and beverage giant, with Citi analysts stating that this expectation reset should lead to some upside later on when the company reports financial results, as PepsiCo is likely guiding conservatively. Meanwhile, analysts from TD Cowen also maintained their outperform rating on PepsiCo, stating that they have confidence in the company’s ability to navigate a volatile consumer environment “due to the strength of its brands, packaging flexibility, and importance to retailers.”

Meanwhile, Coca-Cola performed much better in Q4, beating Wall Street estimates and reporting 12% organic revenue growth, far ahead of an 8.8% consensus. Not only did Coca-Cola benefit from continued price increases, but it also reported positive volume growth of 2%, which is far better than what was reported by PepsiCo.

In terms of guidance, Coca-Cola is also looking better, guiding for organic revenue growth of 6-7%, ahead of a 5.9% consensus.

Microsoft beating AWS through AI?

As reported by CNBC and as we recently discussed in our Amazon Q4 earnings review, AWS is still the cloud leader, but Microsoft is rapidly closing the gap. According to CNBC's report, this can be attributed to the company’s edge in AI services through its partial ownership of OpenAI.

According to Microsoft management, 6 points of growth in Azure in the most recent quarter came from AI services, which is up significantly from 3 points in the prior quarter. This eventually drove 30% growth in Azure, against just 13% YoY growth for AWS. Currently, Azure is a faster-growing service, and we should not be surprised to see Microsoft take more market share from Amazon in cloud computing as the role of AI functions becomes even more significant.

According to Yun Kim, growth in Azure should even accelerate over the next few quarters “as tailwinds from new workloads from both new cloud deployments and GenAI initiatives ramp meaningfully.”

In the meantime, however, it is not all good news for Microsoft as The Wall Street Journal reported last week that the first users of Microsoft’s new artificial-intelligence assistant software (Co-pilot) are reportedly not completely satisfied with the product due to, while the tool is useful, it often not living up to the price.

First users and testers noted that the software has the tendency to make mistakes, which worries its users, making the current $30 price per user quite heavy. Juniper Networks' Chief Information Officer Sharon Mandell said the following after using the software for six months:

"I wouldn’t say we’re ready to spend $30 per user for every user in the company."

Furthermore, some early users stated that the initial excitement about the AI product faded away quickly. Lenovo, another early adopter of the software, noted that “besides the AI used for transcribing Teams' meetings, there was around 20% decrease in the use of Copilot for most software after a month,” as reported by Seeking Alpha.

Clearly, while Microsoft has a lot going for it, it is not only plain sailing.

Nvidia has become the third-largest U.S. company

With Nvidia shares having run up a further 46% this year, Nvidia has overtaken both Amazon and Alphabet to become the world’s third-largest company, only trailing Apple and Microsoft.

Driven by incredible financial results and the promise of the AI boom, Nvidia shares have breached the $700 mark and now trade at around $726 per share. In terms of valuation, this means shares now trade at 34x the current 2025 EPS consensus, which is far from bad. Although, by current estimates, shares also trade at 26x the 2027 consensus, which is far less favorable and reflects an expected slowdown in growth.

Nike is cutting its workforce and faces scrutiny from analysts

Nike announced a $2 billion cost re-allocation together with its Q2 result back in December and earlier this week announced that it will cut 2% of its workforce as a major part of this, impacting 1,500 jobs. The company is still facing a weak demand environment and is looking to accelerate growth by driving cost efficiency.

However, while the plan itself was well received by investors in December, Wall Street analysts now doubt the company’s execution and believe the transition could take longer than investors are anticipating, which led to Oppenheimer cutting its price target on Nike by 36% to $110. https://seekingalpha.com/news/4068312-nike-losing-traction-as-strategic-re-positioning-likely-to-take-time

Meanwhile, our investment thesis remains unchanged, and we remain bullish on the company’s long-term prospects. You can find our in-depth research on Nike below.

Next week’s most anticipated earnings

As always, we aim to keep you informed on the most notable earnings releases during the week, so stay tuned for our stock coverage posts and dedicated earnings reviews.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.