Enphase, KLA, Comcast – Time to buy or not? Here's my take after earnings

Three exciting earnings reports to review! Let me take you through the numbers and developments, putting them into perspective and telling you whether I am buying or not.

Last week, the earnings season really took off, with some of the largest and most exciting companies reporting earnings, leading to significant share price movements. Some stocks jumped by double digits, while others fell at an ever quicker rate.

As always, these earnings give investors, shareholders, analysts, and everybody else on Wall Street a unique quarterly insight into how the business is performing financially but also in terms of underlying developments through the earnings call.

Therefore, these quarterly earnings releases are of incredible value. They allow us to analyze the business and its performance and adjust our expectations accordingly. This then gives you and me the chance to re-calculate what upside is left to determine whether now is the time to buy or not!

In this post, I am going to do precisely that, in this case, for three stocks that are either in my portfolio or on my watchlist. I will give you a quick and hopefully concise overview and analysis of the quarterly results and trends and highlight and discuss the most important developments and aspects for (potential) shareholders. Eventually, I will give you my stance on the company, explaining why I am buying or remaining on the sidelines.

My goal is not to tell you what to buy and ignore but rather to put the numbers into perspective, discuss developments, and explain why I am buying or not.

Without further ado, let’s examine each of these brilliant businesses, starting with Enphase, which was one of the biggest winners last week!

(Please feel free to skip to those companies you are most interested in! We cover all three extensively in this post to tell you all you need to know!)

Enphase Energy, Inc. – Potentially one of the greatest bargains today

Enphase Energy is one of the leaders in the solar energy sector through its distinctive solar microinverter product and total energy system offering, including batteries and car chargers. The company has been one of the most significant in the industry for years, with a solid global presence and high-end solar energy products. In fact, Enphase today has a market share in microinverters that approaches 50% in the U.S. and around 40% globally, which positions it favorably toward the long-term expected growth for the solar industry.

This is why I own the company in some of my more aggressive portfolios and have it on the watchlist of about all the other ones. Fundamentally, this is a great company with very bright prospects. However, it is facing significant near-term headwinds, and its financial performance over the last year or so has been lackluster, leading to shares falling by 65% from a recent high.

For those not so familiar with this company, I wrote a more in-depth analysis a few months ago, which you can find through the button below.

So, where do we stand today?

The results need to be put into perspective

Earlier this week, Enphase released its Q2 earnings. While it completely fell short of expectations in terms of financial results and near-term guidance, shares jumped up roughly 14% over the week as there is some hope a bottom might be in and a recovery is underway.

Starting with the, at first sight, not-so-great Q2 results, Enphase reported revenue of $303 million, which was down a staggering 57% YoY, down from the 34% growth reported in the same quarter last year and missing the consensus.

In the quarter, Enphase shipped only 1.4 million of its microinverters, compared to 5.2 million in the same quarter last year, which is pretty staggering, even as it somewhat exaggerates the situation. You see, Enphase continues to undership actual demand to get its channel inventory to normalize.

Due to the very sudden significant increase in interest rates and drop in solar installation demand that followed, a lot of Enphase installers were stuck with Enphase products, which led to Enphase having to undership actual market demand in order to allow these installers to get rid of their inventory.

Therefore, in the latest quarter, Enphase undershipped actual demand by $92 million, meaning Enphase managed to generate only $303 million in revenue while there was demand for $396 million. This makes the revenue decline look a lot worse than it actually is. Excluding this impact, revenue was down “only” 44%, which is already quite a bit better.

And here comes the big positive of the earnings report: Enphase management indicated that channel inventory finally returned to normal levels at the end of Q2, meaning we can expect quite a big improvement in revenue in the remainder of this year.

Indeed, a bottom seems to be in for Enphase. This is also visible in the revenue growth trend below, which shows that Q2 was already somewhat of an improvement from last quarter when revenue was down 64% YoY. This indeed looks like a bottom as it breaks a trend of six consecutive quarters of revenue growth deceleration. This is a big positive and seems to be a turning point for Enphase.

In terms of regions, both Europe and the U.S. showed a sequential improvement, indicating both regions are seeing a positive shift in demand as interest rates slowly come down, at least in Europe, and channel inventory has normalized.

As of the most recent quarter, the U.S. continues to account for the majority of Enphase revenue at 65%, and this is also where revenue growth improved the most in Q2, growing a very impressive 32% sequentially. Particularly in California, the operating environment improved quite a bit, also helped by better NEM 3.0 adoption, which is now actually turning into a tailwind for Enphase.

In previous quarters, NEM 3.0 was a big headache for Enphase as it led to a significant near-term decline in demand. This is what I wrote about it before:

“NEM 3.0 is a new solar energy legislation in California that lowered the reduction in export rates, which refers to the value of excess electricity pushed onto the grid by solar systems, by 75%. This reduced the overall base savings and increased the payback period of home solar, which obviously impacted demand.

The new legislation aims to incentivize homeowners to add a battery pack to their solar installation to become more self-sufficient and contribute to a more resilient electricity grid. Due to lower costs, the eventual package payback period should be roughly equal to the prior system.”

Positively, NEM 3.0 is actually turning into quite a positive as demand seems to return, and Enphase now has a way higher battery attach rate. As of the most recent quarter, under NEM 3.0, Enphase reported a battery attach rate of over 90%, compared to a prior 15% and most of these batteries are Enphase’s own!

As a result, Enphase is able to report 1.5x higher revenue per account in California, which is terrific! This should remain quite a tailwind for Enphase in coming quarters as demand further improves.

In Europe, one of Enphase’s big growth engines, demand hasn’t quite returned as strongly, with revenue only up 3% sequentially. However, I expect Europe to return to high growth in the longer term once demand normalizes and Enphase grows its presence on the continent. In my view, Europe will soon account for 50% of revenue again and should be able to grow at roughly 2x the speed of the U.S., where Enphase already has much better penetration.

Moving to the bottom line, Enphase also performed more than respectable, with its margin remaining best in class, even when excluding the IRA tailwind. For Q2, Enphase reported a gross margin of 47.1%, which was up 90 bps, although mostly driven by IRA benefits.

You see, Enphase is a big beneficiary of the IRA (Inflation Reduction Act), which offers tax benefits to U.S. manufacturers of solar equipment. For Enphase, about 2/3 of its global microinverter manufacturing capacity is located in the U.S., meaning the company receives tens of millions in benefits each quarter. Excluding IRA benefits, the gross margin would have been closer to 41%.

Moving further down the line, the operating margin benefitted from the gross margin improvement but was down roughly 12 percentage points nevertheless, due to the revenue decline and steady operating expenses. No big surprises there, and this should recover rather quickly once the top line does.

For EPS, this resulted in $0.43 per share, down over 70% YoY, which isn’t any sort of surprise considering the top-line decline and continued investments made. Positively, FCF remained positive at $117 million, allowing Enphase to maintain a healthy balance sheet with $1.65 billion in cash and a manageable $1.2 billion in debt.

This all looks good enough for now. Though, on a slightly more negative note, SBC does remain high at 17.4% of revenue, although this number is also elevated due to the poor top line performance. Actual SBC dollars are down slightly from last year, so I expect this number to come down to the high-single-digit range pretty soon, which is more than acceptable for a growth stock like Enphase.

Also, management is trying to offset dilution by buying back some shares. In Q2, it bought back $100 million worth of shares, more than offsetting dilution, so overall, this is not too bad. I don’t think shareholders have to worry about SBC at this point.

Enphase remains compelling longer term

All in all, the results aren’t that bad at all once put into context. Sometimes, it is important to dive just a little deeper to understand the underlying narrative. For Enphase, its long-term story remains intact and quite bright.

Despite current headwinds for the industry, its long-term outlook remains more than intact as well. You see, while the solar industry, or at least parts of it, might be facing significant headwinds in the near term, the long-term outlook is tremendous as there is no going around solar as the next most important source of energy.

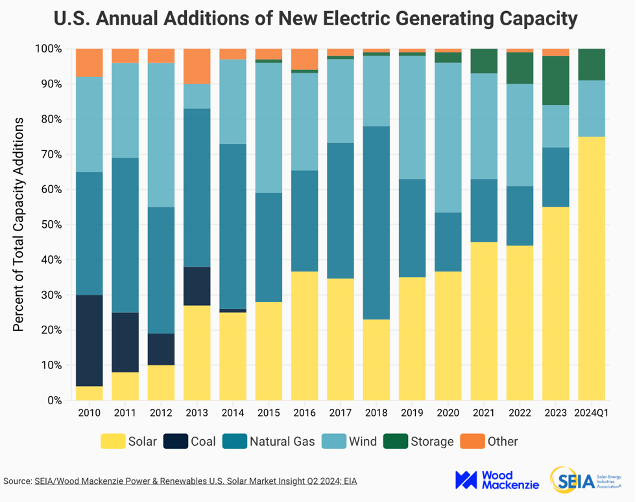

We can already clearly see this developing today over the last three years and expected for 2024; solar will be the predominant new generating capacity to the grid. In 2023, solar energy accounted for 55% of all new electric capacity added to the grid, making it the first time in 80 years that a renewable energy resource has captured a majority of new capacity added. Just check out the rise below; a clear shift is visible.

And that is not all as, by current projections, to satisfy energy demand, solar energy “annual installs will need to grow from less than 22 GW in 2022 to nearly 140 GW by 2030, with cumulative totals over 800 GW by the end of the decade,” according to the SEIA. This points to significant growth ahead.

For the entire solar energy systems industry, this is expected to result in annual growth at a CAGR of 16% through 2032, according to Precedence Research. Obviously, this is an interesting market.

Now, in the case of Enphase, we are looking at a company with a 40-50% global market share (and expanding) in one of the most critical and advanced parts of these complex solar energy systems. Unsurprisingly, the solar microinverter market is expected to grow at an even faster 19% CAGR through the end of the decade, and Enphase is the primary beneficiary of this growth.

I mean, this part of the investment thesis is pretty straightforward and undeniable. Whatever way you look at the situation, Enphase is bound for significant growth in the coming years as demand and the supply chain normalize. This is why I still love Enphase and its prospects.

Outlook & valuation

Moving to the outlook, we can see a clear improvement in management’s guidance. It now points to Q3 revenue in the range of $370 million to $410 million, which represents a 29% YoY decline, which is significantly better than last quarter.

Also, management stated that 85% of this guided revenue has already been booked, which is Enphase's healthiest backlog in over a year, signaling a clear improvement in the business once more.

This also should have a positive margin impact, with a gross margin expected to be between 47% and 50% with net IRA benefit and 39% to 42% before net IRA benefit.

Overall, I am quite positive about these results and guidance, but they still fall short of my expectations, especially with EPS declining more than I expected. As a result, I have had to reset my expectations for this year, as a recovery in H2 won’t be as strong as I hoped.

Also, I have slightly trimmed my 2025 estimates as I expect some lingering economic weakness. However, EPS should rebound quickly, and my estimates for 2026 and 2027 remain unchanged. As a result, Enphase's long-term outlook remains compelling.

Based on these estimates and the share price jump after the results, Enphase shares now trade at roughly 22x next year’s earnings, which isn’t the cheapest, but also far from expensive considering its market position, growth prospects, and industry leading financials.

Put another way, its premium to the sector is justified, in my view. It still translates into a PEG, which sits in deep vale territory at below 1, which is somewhat insane.

Overall, I think an earnings multiple of 23x puts it right around fair value, and using this and my FY26 EPS projection, I calculate a target price of $162 for the end of 2026, translating into potential annual returns of just over 13%.

Now, considering the risk profile here, this doesn’t sound overly attractive, but considering the room for significant growth beyond 2026 and even the decade, I deem it plenty to rate shares a buy. While I wouldn’t make Enphase a very large position in my portfolio to manage risk and volatility, I do think the company, after these results, remains a compelling long-term buy!

Personally, I am buying at these levels!

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

We appreciate you all!!

KLA Corporation shows why it is in its own league

Let me just start this by saying KLA is one of my absolute favorite companies in the semiconductor sector, with significant long-term growth potential thanks to its focus on several crucial semiconductor manufacturing processes, for which it develops high-end equipment. For those unfamiliar with the company, this is the description I used last time out:

“To put it more understandably and without going too much into detail (which most investors won’t care about), it provides a range of products and services to help semiconductor manufacturers monitor and control various aspects of the semiconductor manufacturing process to improve yield and efficiency by giving them tight control of their processes and by identifying issues in time. This means KLA’s products contribute to the precision, quality, and efficiency of semiconductor manufacturing by providing tools for accurate measurement, defect detection, and process control. These capabilities are essential for producing high-performance and reliable semiconductor products, and these are growing in importance.”

Obviously, this focus and these operations make it a prime beneficiary of the projected growth for the semiconductor industry and equipment market. For reference, according to Markets and Markets, the semiconductor equipment market, one of my absolute favorite industries, is projected to grow at a steady 10.4% CAGR through the end of the decade.

However, thanks to KLA’s focus on higher-growth areas of this market, one can safely assume this company will grow its revenue by double digits for many more years. I am very bullish and happy to hold shares in this company (and after reading this earnings analysis, I believe you’ll feel the same).

Just how tremendous this business is was once more highlighted last week as the company released its quarterly results last Wednesday, which beat the Wall Street consensus on top and bottom lines.

KLA reported fiscal Q4 revenue of $2.57 billion, sitting above the midpoint of guidance and up 9% YoY, and clearly showing a solid continuous improvement in growth and the operating environment as growth turns positive again.

As you probably know, the semiconductor industry experienced a cyclical downturn in 2023. Weak consumer spending health impacted demand for consumer electronics and semiconductors. As a result, large foundry players lowered their capital spending, and demand for KLA’s semiconductor equipment fell as well, resulting in a challenging year in which revenue declined.

However, we can now clearly see a positive turn in the industry and demand for KLA’s equipment as management indicates that customer demand increased solidly in the quarter, something we could have seen coming after hearing ASML and TSMC management being upbeat last week.

The semiconductor industry is seeing a strong uptick in growth and demand, and this is visible across the industry. KLA management indicated that it continues to see signs of a strengthening market environment for customers at the leading edge, and we can safely assume growth will continue accelerating as the year progresses.

Definitely a lot of positive signs for KLA!

Meanwhile, KLA is also seeing demand recover quicker than expected compared to many of its peers, thanks to KLA being a massive beneficiary of the AI boom and the focus on more advanced nodes.

A continuation of scaling and incorporation of new technologies and slowly rising capital intensity continues to be a long-term tailwind for the company, which is in part driven by the push for AI technologies. As KLA management explained, “AI adoption is driving higher volume wafer manufacturing, more complex designs, larger die and chip size, and growing advanced packaging demands which support an increase in process control intensity,” which is one of KLA’s strengths.

In other words, the push for more advanced technology leads to far higher demand for KLA’s equipment. As a result, KLA is exceptionally well positioned and already seeing this edge materialize in today’s recovery.

Moving to the bottom line, KLA performed excellently, reporting a gross margin of 62.5%, sitting at the upper end of the guidance and above Wall Street expectations. Meanwhile, operating expenses were $553 million, resulting in an operating margin of 41%, up 190bps YoY thanks to strict cost control and a return to top-line growth.

Further down the line, this translated into a net income margin of 34.7%, which is best in class, and up 320 bps YoY, which is pretty tremendous. This led to an EPS of $6.60, up 24% YoY, as the recovery is in full motion.

Finally, FCF in Q4 was $832 million, bringing the last 12 months' total to $3 billion. This represents an FCF margin of 31%, which is still excellent, considering this was due to a challenging year for KLA. This also meant the company maintained a healthy balance sheet with $4.5 billion in cash and debt of $6.7 billion.

This allowed it to continue paying out a very solid dividend, yielding 0.74%. Now, I know this might not sound very impressive or compelling, but just consider that KLA has grown its dividend at a brilliant 15% CAGR over the last almost 20 years, growing it for 14 consecutive years. Also, the payout ratio is still very low at 25%, leaving it with plenty of room to keep growing for many more years.

In fact, KLA definitely is on my top dividend growth list!

China and export restrictions remain a pain in the ass for KLA shareholders

Overall, KLA delivered just excellent financial results that exceeded most expectations. Really, I don’t think shareholders can wish for much more here.

However, KLA shares are nevertheless down over the last month and week, which can be fully blamed on the U.S. government and its semiconductor crackdown on China, to which KLA has quite a bit of exposure.

As of the most recent quarter, China accounted for 44% of KLA’s sales, a slightly elevated number due to recent weakness in other regions like Korea (Samsung) and Taiwan (TSMC). In a more normalized environment, China accounts for roughly a mid-twenties percentage, but still, this is quite a bit of exposure to uncertainty.

You see, you probably didn’t miss it, but semiconductor stocks got completely annihilated last week as news surfaced claiming the U.S. is looking to impose further restrictions on the export of equipment to China. The semiconductor industry even lost $500 billion in value in a single day, with KLA also losing close to 10% in market value.

Now, the export restrictions are said to specifically target ASML to prevent its advanced equipment from being shipped to China, which obviously caused fears and concerns across the entire industry. For KLA, there also remains a constant threat of restrictions impacting its business, which could jeopardize a maximum of 25% of its revenue.

So far, KLA hasn’t felt as much of an impact from all the imposed restrictions as it doesn’t operate in the highest end of the market, but there is no certainty it won’t be hit with restrictions later on, which could remain a drag on the share price performance, and maybe rightfully so.

Overall, I wouldn’t be too worried as a (potential) shareholder—I can at least say I am not. You see, the possibility of all of KLA’s China revenue being threatened is very minimal due to its place on the semiconductor value chain. And even if it were to be hit severely by restrictions, I am sure that during the next upcycle, there will be plenty of demand from other customers to offset a big portion of this weakness.

At this time, I am not overly worried, as KLA is not facing the same risks as Applied Materials and ASML do, for example. Again, this makes KLA a somewhat more attractive investment compared to peers.

Outlook & Valuation

In terms of guidance, KLA also didn’t disappoint. First of all, it left its outlook for the semiconductor industry unchanged, still expecting the WFE market to be in the mid $90 billion range, with a stronger second half of the year. On top of this, KLA management also indicated that for 2025 it is quite optimistic, expecting another year of solid growth, fueled principally by growth and leading-edge investments in both Logic/Foundry and in memory.

For KLA, this means it also continues to expect growth to accelerate throughout 2024, meaning growth will once again reach solid double digits in the second half of the year and into 2025.

For fiscal Q1, management now guides for revenue of $2.75 billion plus or minus $150 million, which represents a 14.6% YoY growth at the midpoint. Furthermore, the gross margin is forecasted to be around 61.5%, an improvement from last year as higher revenue volumes offset by weaker anticipated product mix, which tends to come in stronger than expected, so I am optimistic here.

Regarding operating expenses, KLA now expects growth of only 3%, and based on the numbers discussed, we can assume the operating margin to be around the 41% mark. Finally, for EPS management guides for $7 plus or minus $0.60, representing a 22% increase YoY.

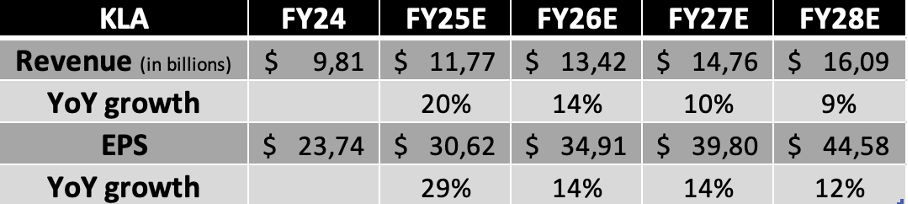

Overall, this guidance and the quarterly results are very solid. They contain few surprises but sit well ahead of expectations, which is exactly how I like them. Also, it allows me to positively revise my financial projections for the company as the recovery is ahead of schedule and the company’s long-term outlook continues to improve.

Last time out in May, I rated KLA shares a Hold due to valuation concerns. Now, expectations have improved, which is positive, but at the same time, shares have also made significant gains. Shares are up 37% YTD, 70% over the last year, and another 14.5% since I last covered shares on May 1st.

As a result, these now trade at almost 26x this year’s earnings compared to 24x back in May, not making shares much more attractive, even as long-term projections have improved. For reference, this is a 35% premium to the 5-year average multiple.

Looking at the current PEG multiple, which better represents longer-term growth, we are looking at a multiple of 1.5, which is looking a bit more attractive as it is a 13% discount to the 5-year average and a 22% discount to the sector median, despite the company being one of my absolute favorites here. From that perspective, shares might not be that expensive as it seems like the current multiples are simply reflecting growth expectations for the years ahead.

In the end, I do think KLA remains one of the best and most compelling players in this sector, and a multiple of around 25-26x earnings seems more than justified. However, using this multiple and my FY26 EPS estimate, I calculate a target price of $873, which only translates into annual returns of 5-6%, which is nowhere near enough to buy shares at this time.

Therefore, I maintain my hold rating for KLA and do not feel that there is enough upside right now to justify increasing my position. Shares would start looking much more attractive below $820-$830 per share.

Comcast remains a value opportunity

Whereas results from KLA and Enphase were well received by investors, we can’t quite say the same about Comcast, which saw its share price take a 5% hit in the trading session that followed the results announcement, even as the results were far from bad and contained plenty of significant positives. Also, there didn’t seem to be much more room for downside at current multiples, but never underestimate the financial markets, right?

Positively, shares did recover as the week progressed, but these are still down 10% YTD and over 8% since I published my deep dive into the company in March, in which I concluded investors were misjudging the company, leading to an unjustified discount and solid potential returns.

Sadly, shares have underperformed quite a bit since.

Now, Comcast will be quite a familiar name for most of you, so I am not going to spend a lot of time on that. I will just jump right into the Q2 results, putting these into perspective and showing you there is plenty to be optimistic about.

For those unfamiliar with the company, check out my March deep dive below linked to below. It is a great introduction into all that is Comcast, explaining its growth opportunities and weak spots.

Comcast announced its Q2 financial results last week, and in terms of top-line numbers, it didn’t perform all that poorly. Yes, it missed the revenue estimate by roughly 1%, but it beat the EPS consensus by 9%, which is more than a solid profit beat.

In terms of revenue, Comcast reported a decline of 2.7% to $29.7 billion. At first sight, this doesn’t sound great, but we should consider that revenues can be a bit volatile in the entertainment sector. This is not different for Comcast as its revenue performance was influenced by a tough comparison to the same quarter last year in which it released two of 2023's top-five grossing films at the worldwide box office. With this missing this quarter, the studio's segment performed significantly worse, leading to this revenue decline. Excluding this, revenue would have been flat YoY.

Therefore, the top-line numbers don’t fully reflect the performance of the business. Also, looking at Comcast’s top 6 revenue drivers long-term, we can see the performance was even better, growing mid-single digits over the last 12 months and now accounting for over half of total revenues, which should help the company steadily increase growth a bit, excluding seasonality.

How top-line growth fluctuates is visible below!

Connectivity & Platforms performs as expected

Let’s then take a closer look at the individual segments, as this will tell us a lot more about the underlying performance. We'll start with Connectivity & Platforms, for which revenue was down marginally to $20.2 billion. Strong growth in the connectivity businesses was offset by declines in video and voice revenue, which have been in a secular decline for a while now as they are being replaced by streaming.

It is also no secret that the company’s biggest product – its broadband services – hasn’t been performing very well. In fact, since most people and investors see Comcast primarily as a broadband business, this poor broadband performance has been the leading reason for skepticism toward the shares.

However, as I explained in my deep dive, the situation isn’t as bad as it may seem at times. Comcast’s broadband revenues are actually pretty steady, thanks to growing ARPU (Average Revenue per User) and slightly declining user numbers. As a result, the broadband business continues to be a great source of cash flows for Comcast, which allows it to invest in faster-growing parts of the business, such as its wireless service, theme parks, and streaming.

Of course, steadily losing broadband customers is far from ideal, but don’t forget that Comcast is still the largest broadband provider and is growing its coverage quite rapidly, somewhat offsetting the declining demand. At the end of Q2, Comcast counted 32 million broadband customers, flat compared to the end of 2021. While this trend is far from great, I don’t believe it is as worrying as some think.

Looking at Q2, broadband revenue actually grew 3% YoY, thanks to strong ARPU growth of 3.6%. This was helped by secular growth drivers like growth in internet usage and more subscribers switching to higher, more expensive internet speeds. This is driving contract value up for Comcast, offsetting declines in users. In Q2, Comcast did report a significant subscriber decline of 120,000, which isn’t great, but it is worth adding that Q2 tends to have some seasonal weakness.

Video and voice performed much worse, declining 8% and 11%, respectively, due to significant subscriber losses, which weren’t surprising. Positively, these products are rapidly declining as a percentage of total revenue, slowly lowering the impact of the secular decline in the business.

Luckily, Comcast’s wireless business continues to fire on all cylinders, at least offsetting some of the weakness in other parts. Domestic wireless revenue grew 17% in Q2, thanks to 20% growth in users or net additions of 322,000 to over 7.2 million in total.

This segment is one of Comcast’s biggest growth drivers as it has been growing for over 20% for many years now. And with penetration still, at only 12% of broadband subscribers, there is also plenty more upside for Comcast. I do expect this business to remain a significant growth driver for at least a few more years, offsetting weakness in other areas.

Content & Experiences dissapointed

The Content & Experiences segment did not perform as well, seeing revenue decline by 7.5% to $10.1 billion, which can be mainly attributed to declines in theme park traffic. Notably, theme park revenue declined by 11% YoY after a record Q2 last year.

This decline surprised management and Wall Street, even though we could have seen it coming. It turns out that the great growth in previous years following the COVID-19 pandemic contained some pulled-forward traffic, which is now leading to less traffic compared to prior years.

We will probably continue to see this segment struggle for the remainder of this year, until the opening of Epic Universe in 2025 gives it a positive boost.

Nevertheless, the performance here was disappointing, even as the long-term thesis remains intact.

The Media segment was affected by lower box-office revenues

For the Media segment, revenue actually increased 2% YoY, mainly thanks to Peacock continuing to perform very well. Revenues grew by 28% YoY, thanks to 9% growth in advertising and 38% growth in the paid subscriber base to 33 million.

This latter number was flat sequentially, which shows a slowdown, but this is no surprise, considering there were no notable content releases during the quarter. In fact, I am positively surprised the streaming service was able to retain its subscribers.

With the Summer Olympics now kicking off and the NFL returning in September, I expect a stronger performance in the second half of the year!

Now, whereas streaming was a big growth driver, studios were the opposite, with revenue declining 27% YoY and EBITDA by 51%, which reflects the unfavorable timing impact from a great blockbuster quarter last year and few releases this year.

Positively, Comcast does have a bunch of great content coming out in the second half of the year, including a great opening of Despicable Me 4 earlier this month and Twisters currently.

Long-term, the Media segment should remain one of Comcast's growth drivers, with the company’s studios pushing out one blockbuster after another in recent years and Peacock showing great retention and growth. I am bullish!

Comcast’s bottom line performance was strong

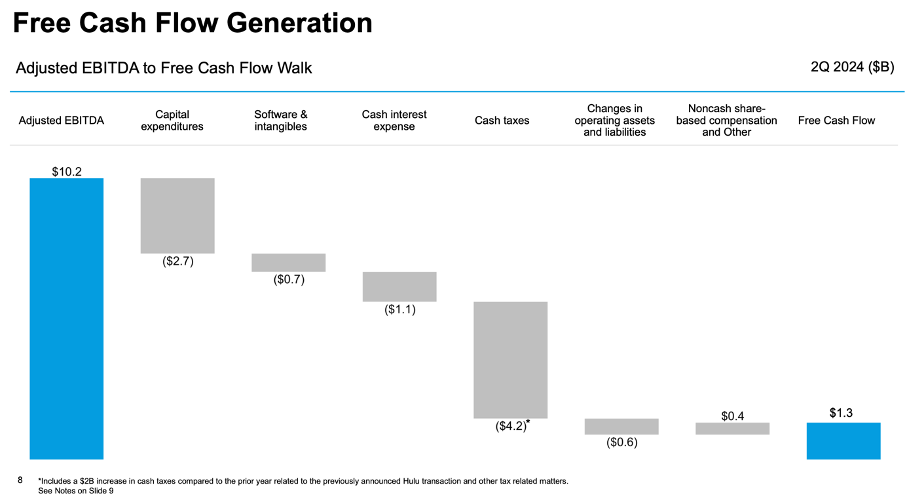

Whereas the top-line number reported for Q2 didn’t quite impress anyone, Comcast performed much better on the bottom line, beating the EPS consensus by a solid 9%.

Total EBITDA was down 1% YoY at $10.2 billion, which is unsurprising considering the weaker top line and margin weakness as a result in some segments. However, in part, thanks to a lower share count and minimal expense growth, EPS grew by 7% YoY to $1.21, which is great!

Finally, FCF came in at only $1.3 billion as this was impacted by a $2 billion YoY headwinds due to higher taxes. Though, this didn’t stop the company from returning a significant amount of cash to shareholders, returning a whopping $3.4 billion in Q2, including $2.2 billion in share repurchases.

Over the last 12 months, Comcast has now lowered its share count by 6%, and over the last three years, this has declined by an impressive 16%, significantly contributing to EPS growth.

In addition, investors now receive a rich 3.12% yield after six years of consecutive increases. Also, the payout ratio remains low at below 30%, leaving the company in a great position to keep growing the dividend steadily at high single digits, even as profit growth might be slightly lower. In fact, the company could more than double its payout, growing at a CAGR of 24%, without exceeding a 50% payout ratio.

Comcast definitely is a compelling dividend growth investment.

In terms of financial health, Comcast, operating in a capital-intensive industry, isn’t the most compelling. As of Q2, it held total cash of $6.2 billion against total debt of $97 billion, with debt reaching the highest level since December 2020 as the company used debt to fund some of its share repurchases, which I am not a fan of, to say the least.

Now, considering the industry Comcast operates in and its annual FCF, which typically exceeds $15 billion, I think the current financial position is manageable, but I would prefer Comcast to focus a bit more on debt repayment to give it some more financial breathing room.

For now, it is not a thesis breaker, though.

Outlook & Valuation

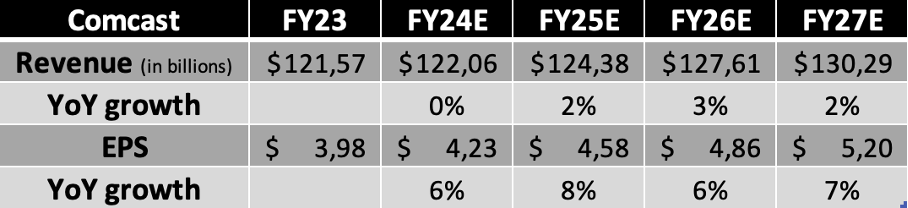

Per usual, Comcast doesn’t issue any real guidance. However, we do know that for its Media segment, in both streaming and studios, the performance should be a bit better, while connectivity should be stable and theme parks somewhat of a weakness. Overall, I expect a slightly better second half of the year, with my FY24 revenue estimate now sitting at $122 billion, flat YoY.

Note that this is quite a bit below what I anticipated in March due to a weaker-than-expected first half. This also led to me trimming my EPS estimate, although only marginally. Longer-term, my expectations remain largely unchanged, with revenue growth most likely remaining in the low-single digits and EPS being boosted by profit gains and share repurchases.

Check out my full projections below.

In terms of valuation, not a lot has changed for Comcast since March, as the falling financial projections offset the share price decline. As a result, Comcast shares still trade at just over 9x this year’s earnings, which is quite a ridiculous valuation, in my opinion, even for a slow-growing stalwart with some declining operations.

In the end, Comcast should still be able to keep growing revenue, even as its broadband business isn’t as impressive as it used to be. Moreover, EPS should continue to grow nicely.

At a 9x multiple and a PEG of 1.3, I still believe Comcast is a deep-value opportunity being mispriced by the market. Considering the growth ahead, I believe a multiple closer to its 5-year average of 13x is justified.

Assuming a still significantly discounted multiple of 10x, I calculate an end-of-2026 price target of $49, representing potential annual returns of 11-12%, including dividends. This estimate leaves a lot of upside for further margin expansion and plenty of room for Comcast's EPS outperformance.

Overall, my conclusion remains the same. Comcast is still a value opportunity and I am happy to buy this anticyclical stalwart at current levels.

That is it for today!

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.