Lam Research Corp. – Now undervalued and poised for outperformance!

It's no secret that Lam Research is a brilliant business, but after underperforming significantly in 2024, it might now be the best-priced semiconductor stock out there!

The earnings season has kicked off again, and there is plenty of exciting stuff to discuss and examine!

In case you missed it, my analysis of the following earnings reports has come out recently! Make sure to check those out as well, with plenty of valuable insights and top buying opportunities.

ASML Holding N.V. – Here is my take after the Q3 earnings and a 20%+ sell-off [FREE]

I am buying LVMH shares today, and here’s why! (Q3 Earnings Analysis)

The Procter & Gamble Company – A brilliant business at a hefty price tag (Earnings Analysis)

Texas Instruments Inc. – An absolute gem in the semiconductor industry (A Deep Dive)

Introduction

Lam Research Corporation LRCX 0.00%↑ is one of the leading suppliers of semiconductor manufacturing equipment globally. It claims a 15% market share in the industry, making it the third largest, only behind ASML (ASML 0.00%↑) and Applied Materials (AMAT 0.00%↑).

However, it doesn’t compete with these larger peers at all. You see, the semiconductor industry is quite fragmented, and due to the extensive technical knowledge and years of R&D required to manufacture cutting-edge equipment for a single manufacturing process, every company tends to dominate its own niche. For Lam, this includes the deposition, etch, and clean solutions within the semiconductor manufacturing process, and it is a dominant player in each of these critical and fast-growing processes.

Let me give you a bit more background on the company and these processes to get a better sense of what it does, starting with deposition.

Deposition is a critical step in the semiconductor manufacturing process. It involves adding thin layers of materials to a semiconductor wafer. These thin films are essential for creating various components and structures within integrated circuits (ICs).

Etching is the process of removing material from semiconductor wafers to create patterns and features. Lam Research's etching equipment is designed to remove material from the wafer surface precisely, another critical process in everyday semiconductor manufacturing.

The cleaning process is essential for maintaining the purity of the semiconductor wafers. Lam Research provides products for wafer cleaning, ensuring that contaminants are removed and the wafers are prepared for subsequent processing steps.

Alright, maybe this doesn’t mean or say much for most of you, but what each of these processes has in common is that they are becoming increasingly important and critical as the semiconductor industry moves to smaller nodes and more complicated processes.

In other words, as the industry advances and processes get more complicated, the need for high-end deposition, etching, and cleaning equipment grows quickly, allowing Lam to outpace the underlying industry, and increasingly so.

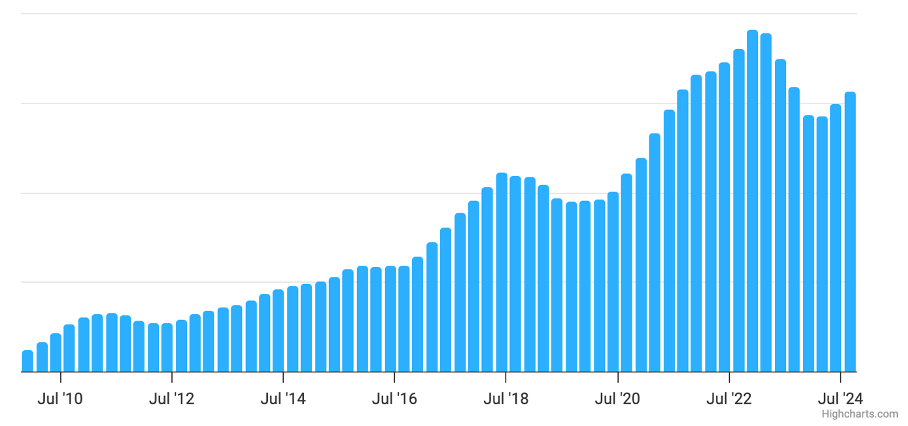

Considering these dynamics, it is no surprise it has turned out to be one of the better investments of the last decade, returning a whopping 905% to investors since 2014, not including its nicely growing dividend, and that is after quite an underperformance in recent quarters due to industry-wide headwinds.

The company has been growing revenues at a CAGR of 15.6% over this same time frame, again, which includes the recent cyclical dip in revenues. Even more impressive, the company grew its EPS at a CAGR of 38.4%, which is incredible and fueled by consistently expanding margins and management significantly lowering the share count.

Management has lowered the share count by 22% over the last decade through significant share repurchases, and the GAAP operating margin has expanded from 5.6% in 2013 to 28.4% in 2023, highlighting incredible margin expansion coming from cost efficiencies and size benefits.

This business has really been firing on all cylinders, and with $17.3 billion in revenue, an installed base of 90,000, a market cap of $100 billion, and great global exposure with 14 primary locations around the world, the company is by no measure small.

In my book, this is quite a brilliant business that should remain a great investment in the years ahead as it remains exceptionally well-positioned. In the words of management, “The best is yet to come for Lam,” with initial investments yet to pay off and the AI revolution driving more opportunities.

Last week, the company released its September quarter results (fiscal Q1) and impressed investors and analysts alike, especially after the ASML warning from the week before. Shares ended the week 7% higher.

Today, I want to review the quarterly results to determine whether Lam shares remain a good buy and whether now is the right time to acquire them.

Let’s see how it did!

Lam impressed with its fiscal Q1 results

Lam came out with its earnings report last Wednesday after-market and managed to post strong quarterly results, beating the top and bottom-line consensus. Let’s just say this was a positive surprise after ASML’s poor guidance from the week before, causing some panic across the semiconductor equipment sector.

Luckily, Lam impressed with revenue and EPS above the midpoint of the guided range and margins coming in above the high end of management’s guidance.

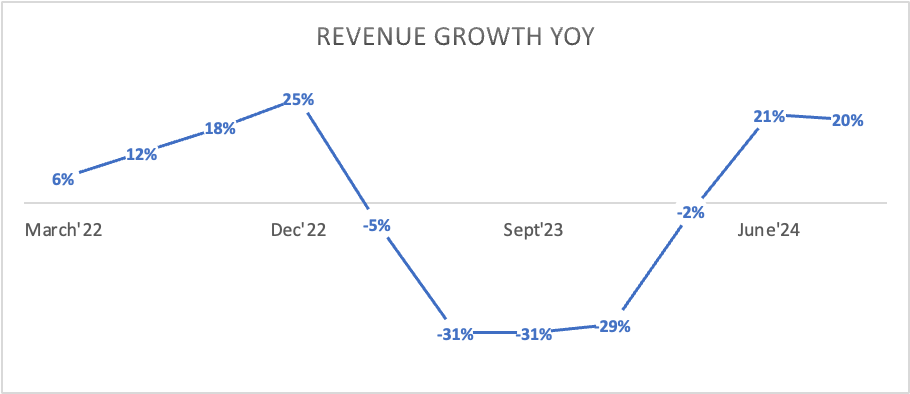

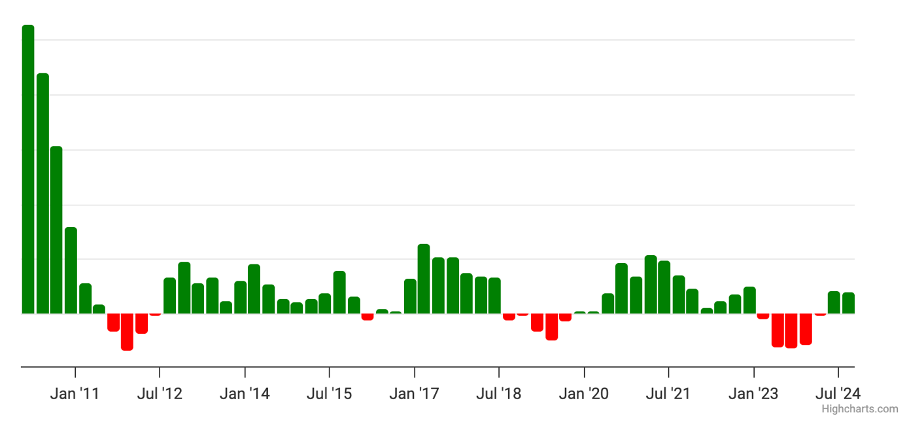

Lam reported fiscal Q1 revenue of $4.17 billion, topping the consensus by $110 million, up 8% sequentially and up an impressive 20% YoY, as it is seeing a solid recovery in the underlying industry and demand. You see, 2023 was a rough year for Lam and the WFE industry. It ended up in a cyclical downturn in response to elevated inventory levels globally and poor consumer spending, resulting in lower electronics demand and lesser demand for semiconductors as a result.

This resulted in lower Capex budgets for semiconductor manufacturers or Lam customers, hurting the company’s growth. Positively, these end markets are now slowly and gradually recovering, and so is semiconductor manufacturing, helped by the AI boom. This leads to higher demand for semiconductor equipment as well. Lam’s quarterly results clearly reflect this demand improvement, returning to solid growth after a double-digit revenue decline in 2023.

In the end, investors will need to deal with and get used to this kind of aggressive volatility. Ultimately, the semiconductor industry is cyclical by nature, and so is Lam, as reflected in the graph below.

Positively, the upcycles always tend to be stronger and last longer than the down cycles, so, through the cycles, Lam is able to report impressive growth nevertheless.

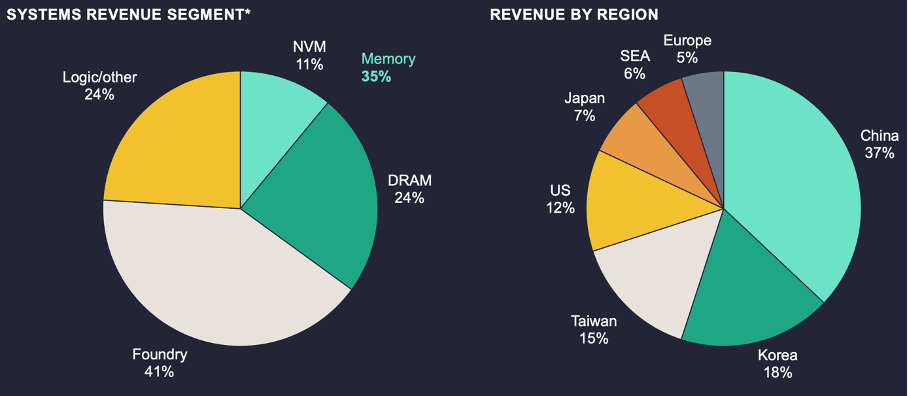

Focusing on the fiscal Q1 results again, a real positive standout and growth driver last quarter once more was CSBG or the Customer Support Business Group, which, in simple terms, contains the service revenues Lam generates by servicing its installed base globally and providing customers with spare parts.

This segment has been a growth driver for years, mostly due to a rapidly growing and aging installed base, allowing Lam to earn much more of these service revenues. Moreover, these are also far higher-quality revenues as they tend to be contract or subscription-based and non-cyclical. In the end, whether a machine is used a lot or less during a downcycle, it needs to be serviced. As a result, the rapid growth here has also led to Lam’s revenues becoming less cyclical.

Today, the segment accounts for 43% of revenue, which is based on still cyclically low system revenues, so realistically it is probably closer to 30-35, but still significant. Last quarter, CSBG grew a whopping 25% YoY, still fueling growth. Long-term I trust this segment will remain a stable growth driver, simply due to a larger number of Lam machines operating worldwide.

Shifting our focus to Lam’s revenue geographically in Q1, we can see that China dropped from 39% of revenue in fiscal Q4 to 37% in the latest quarter, which was stronger than expected but weakened slightly from previous quarters as demand eased and export restrictions kicked in. As a result, this percentage will likely drop to around 30% in the December quarter.

Positively, this weakening in China will be easily offset by a recovery in other regions like Taiwan, North Korea, and the U.S. Therefore, China doesn’t seem to be too much of a concern here.

While it will definitely be a topic of attention in upcoming quarters, the impact is much less severe here compared to ASML or Applied Materials, for example.

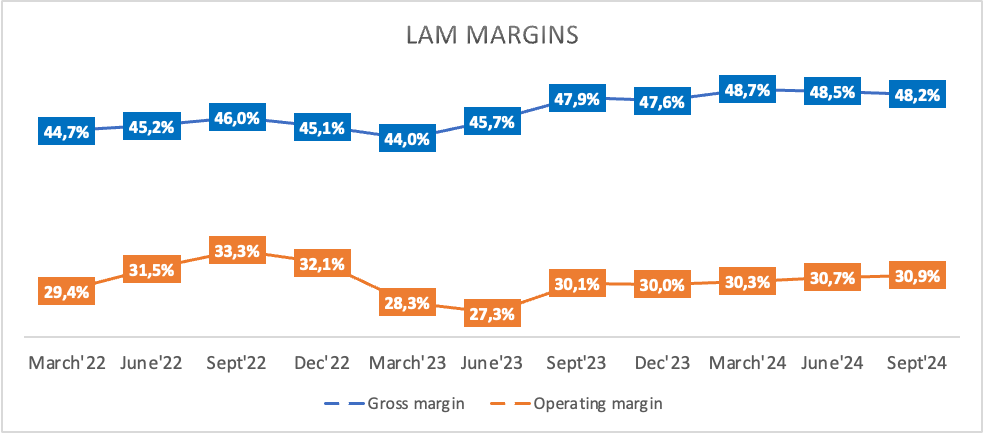

Moving to the bottom-line performance, we can safely say Lam impressed even more against already pretty optimistic expectations. You see, while the business is highly cyclical, Lam really excels in capital management and flexibility, with it able to keep margins fairly stable through the cycles.

As we saw earlier, revenue declined as much as 30% in 2023, but despite the massive top-line drop, its operating margin dropped no more than 400bps at worst, which is pretty impressive!

Looking at the latest performance, we can see margins improving across the board again, thanks to higher revenue and good execution. The gross margin was 48.2%, up 30 bps YoY and ahead of management’s guided range, primarily thanks to improved factory utilization.

Operating expenses were $722 million, up only 5% YoY and growing slower than revenue. However, this did not come at the cost of R&D investments, which still account for 67% of operating expenses and a healthy 12% of revenue.

Still, the little growth in operating expenses against a solid top-line recovery resulted in an 80 bps operating margin improvement to 30.9%. Further down the line, this resulted in EPS of $0.86, topping the consensus by $0.06 and growing 28% YoY.

Finally, FCF generated during the quarter hit $1.46 billion, or 35% of revenue, which is more than solid and easily covered Lam’s dividend obligations and share buybacks, strengthening the balance sheet.

Lam exited the quarter with a total cash position of $6.1 billion and a total debt of $5 billion, leaving it in excellent financial health!

This also leaves it with plenty of room to handsomely reward investors, toward whom Lam has strong commitments. Lam aims to consistently return 75-100% of its FCF to investors through dividends and buybacks.

Last quarter, the company returned almost $1.3 billion to investors through $1 billion in repurchases and $261 million in dividends. Lam shares currently yield an attractive 1.2%, roughly in line with its 5-year average.

Furthermore, this is based on a conservative payout ratio of only 26%, leaving it with plenty of room to grow the dividend further. In recent years, Lam has already been growing its dividend at an incredible pace, averaging a 13.5% CAGR.

Its most recent increase was even more impressive at 15%, and considering Lam’s growth prospects and low payout ratio, I would say there is plenty of room to keep growing this at a mid-teens CAGR, making it a very attractive dividend growth investment.

In terms of consistency, there certainly isn’t anything to complain about either, with Lam having raised the dividend for ten consecutive years now after paying its first in 2014. The dividend is definitely a great bonus here!

And to further increase shareholder value and use its FCF, management also still has the ability to buy back its own shares, which it very much likes to do, having lowered its share count by 22% over the last decade. Today, management still has $9.8 billion remaining on its board-authorized share repurchase plan, which it plans to use in the next 3-4 years, lowering the share count by another 10%.

Just brilliant!

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. We appreciate you being here! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid (only $5 monthly).

This allows me to push out even more content and gets you premium access to even more content, including my full insight into my personal portfolio!

Outlook & Valuation

When it comes to the outlook and medium to long-term growth expectations, there is even more to be excited about – there certainly is no lack of growth opportunities.

Starting with the near-term outlook, management issued bullish fiscal Q2 guidance that came in ahead of expectations. Management now guides for revenue of $4.3 billion, plus or minus $300 million, which points to YoY growth of 14% YoY, slowing down a bit from recent quarters as the underlying market dynamics remain unpredictable and sluggish.

On the bottom line, management guides for a gross margin of 47%, plus or minus one percentage point, at the midpoint, pointing to a slight decline YoY, reflecting a sequential headwind in customer mix. For the operating margin, this translates into a 30% margin, plus or minus one percentage point, which is flat YoY as management is still strictly managing expenses.

Finally, this results in EPS guidance of $0.87, plus or minus $0.10, up 16% at the midpoint.

Looking ahead to next year, expectations are bullish but also still cautious, mainly because there continues to be little visibility on the pace of the industry’s recovery. In recent months, growth expectations for the WFE industry have been trending down amid issues for large WFE customers, such as Intel and Samsung, which continue to see poor demand. As reported by SA, “The analysts now see 2025 wafer fab equipment spending at $105B, down from a prior outlook of $115B. They also tweaked their forecast for 2026 to be $115B, down from a prior range of $115B to $125B.”

Lam itself was also still a bit conservative with its 2025 WFE industry guidance, not being willing to name hard numbers. However, management did indicate it expects the industry to show positive growth, and looking at commentary so far, this will likely be in the low to mid-double digits, though this remains somewhat hard to predict.

TSMC also already confirmed growth in its Capex budget for 2025, guiding for an annual capex of over $30 billion.

Adding to uncertainty, domestic China WFE revenues are very likely to decline by double digits in 2025, which should be more than offset by a recovery in all other regions. Personally, while causing short-term headwinds, I would argue this drop in China WFE revenue is a positive longer-term. Historically, excessive exposure to China hasn’t been a good thing, so this decline to below 30% and toward 20% for Lam in 2024 is a positive to me.

All things considered, I don’t think the current consensus for 16% growth in WFE spending in 2025 to $105 billion is too far off, and Lam will be well-positioned to benefit as the industry recovers.

Lam management remains very optimistic that Lam will be able to outgrow overall WFE growth in 2025 thanks to its earlier discussed favorable positioning and the delayed recovery expected in the NAND market, to which Lam has quite a bit of exposure. This is how management explained it during the earnings call:

“This is due to the critical role that etch and deposition play as fundamental enablers of higher performance, more scalable semiconductor device architectures. Lam is strongly positioned to benefit both from improvement in NAND spending and increased customer investments across multiple technology inflections.”

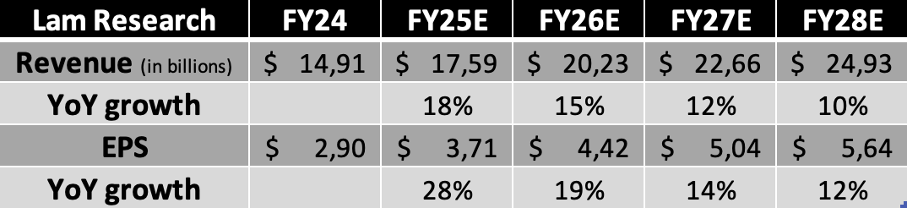

As a result, I think Lam's revenue growth in 2025 will likely be in the mid- to high teens, with EPS probably growing slightly faster, as there is more room for margin improvement thanks to higher revenues.

In the long term, these same factors will continue to benefit Lam and will likely allow it to continue outpacing the underlying industry. As the industry continues to shift its focus to advanced nodes and more advanced technologies, demand for Lam’s equipment will only grow faster. The CSBG segment will remain a significant contributor to this.

Therefore, I believe Lam will continue to grow strongly through fiscal FY26 and FY27 before growth normalizes in the low to low teens in the following years, translating into a really promising and optimistic outlook. As management said, the best might still be ahead for Lam.

All things considered, I now project the following financial results through fiscal FY28. These are marginally ahead of the current Wall Street consensus, which, I believe, do not sufficiently reflect the company’s favorable positioning.

Notably, even as shares gained a solid 7% last week, they remain down roughly 1% YTD after losing some 14% in the last 6 months. Pressure on the semiconductor industry has reached new highs amid continued underlying weakness and mounting Chinese restrictions, which have heavily impacted the share prices of semiconductor equipment manufacturers. I mean, ASML has lost 21% in the last 6 months, AMAT 6%, and KLA shares are flat.

Safe to say the sector has been struggling amid headwinds. As a result, Lam shares have significantly underperformed both the semiconductor benchmark (SMH ETF up 45% YTD) and the S&P500 (up 22% YTD) so far this year.

Therefore, its valuation has also come down quite a bit. Based on the EPS projections above, Lam shares now trade at just 21x this fiscal year’s earnings, a 15% discount to the sector median and in line with historical averages. This is even as the company has a history of outperformance and is expected to outgrow peers again in the years ahead.

Granted, the company has historically been more cyclical, but for long-term investors, honestly, that should not matter at all. Furthermore, on a PEG basis, we’re only looking at a 1.2x multiple, which is nowhere near the 1.8x median for the sector or 2.1x shares traded on over the last five years on average.

In other words, the projected recovery and continued outperformance ahead are not priced in at all at current levels. As a result, I would argue that Lam is among the most attractively priced stocks in the semiconductor industry and is a great undervalued opportunity.

For reference, using the industry’s median PEG of 1.8 and this year’s EPS estimate, I calculate an end-of-fiscal 2025 target price of $120, leaving a 9-month upside of 54%(!). Indeed, the current share price doesn’t at all reflect the growth ahead amid poor sentiment coming from export restriction concerns, to which Lam has limited exposure.

Using a future earnings multiple, the conclusion isn’t much different. Using the stocks’ 5-year average earnings multiple of 21x and my FY27 EPS projection, I calculate an end-of-fiscal FY27 target price of $106. While far less bullish, this still represents potential annual returns (CAGR) of some 12% or 13%, including dividends, which is more than enough to beat the market.

Long story short, Lam shares are among the most attractively priced in the sector, and I am more than happy to buy them at current levels. At a share price of around $78 today, there is good downside protection and great potential to outperform most benchmarks, assuming you can stomach some volatility.

In conclusion, I rate shares a Buy and am happy to keep adding to my position as long as Lam shares trade at a discount this severe.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

I was looking for a play in the semiconductor industry that was not overpriced and with good long term growth and LRCX might be the one. Good insight from you and great read. I will research more on them. Thank you

I don't get you point, when you said that an expected China revenues decline could be positive by recovering in other regions.

The China revenue represent ~37%. How would they replace this demand?

Thanks