Portfolio Update Jan. 2025 + New Year's update, reflections, and predictions

Time to reflect on 2024 and set our goals and predictions for 2025. And, of course, for our paid subs, there is a detailed update on my portfolio!

Here we are in 2025, with the very first post of the year: my New Year’s message and the Portfolio Update for January 2025.

But first of all, I wish you all a very happy, healthy, and hopefully profitable 2025!

Also, I would like to thank you all for supporting this publication and joining me on this journey over the past year. 2024 was my first year as an independent writer on Substack, and it has been a journey. While it was a rocky start in the first few months, starting from absolutely zero and having to find my way around things, InvestInsights quickly gained traction halfway through the year, and growth has only continued to accelerate since then!

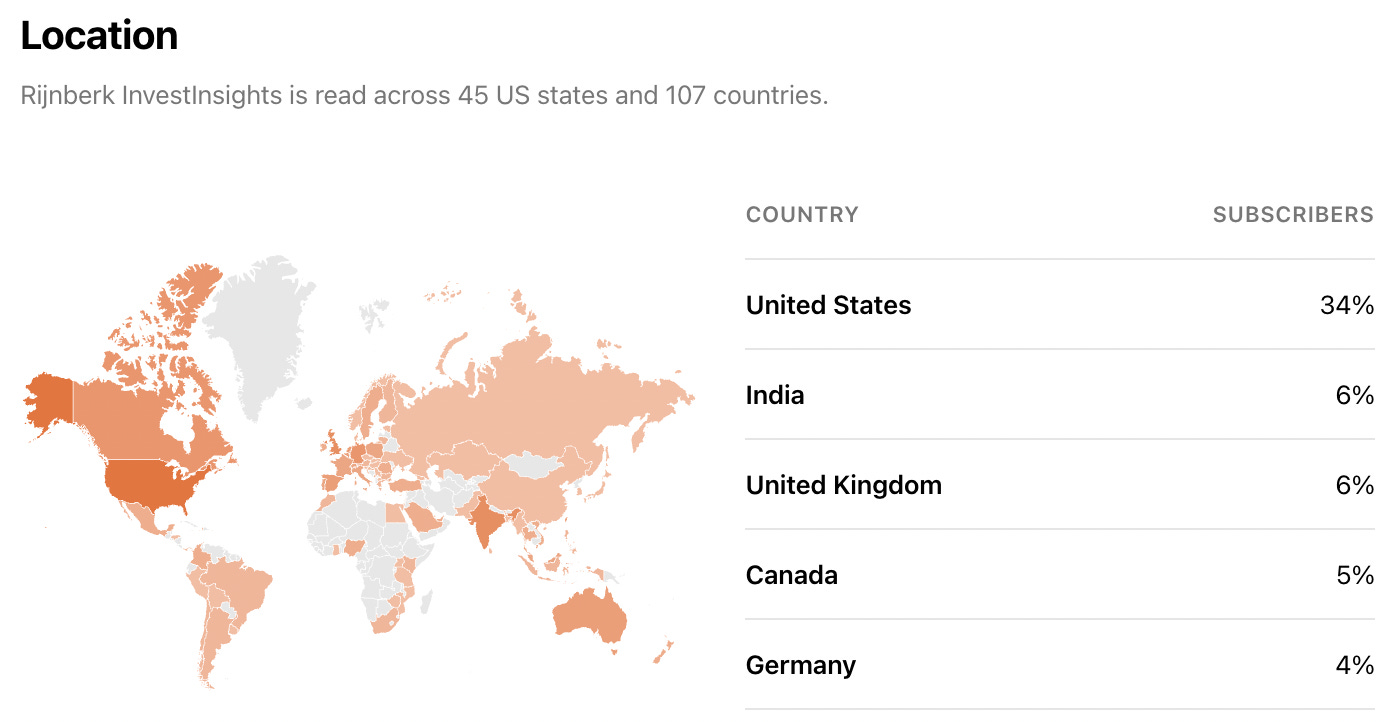

Rijnberk InvestInsights has been in existence for exactly one year. We have grown to 5,500 followers and almost 3,000 subscribers from 107 countries and 45 U.S. states.

This absolutely surpassed all my expectations and I am really proud of the way the publication has developed over the year.

We have also grown a remarkable paid subscriber community, for which I am really grateful. It fills me with pride and joy to see that so many of you value my opinion and research enough to pay a small monthly or annual fee to show your appreciation and get access to even more content and insights.

Together with all of you, I hope to grow much further in 2025 and become one of the best investing-related publications on Substack for both free and paid subscribers.

For 2025, this is roughly what you can expect in terms of content on a monthly basis:

Free content:

A comprehensive Deep Dive (or earnings analysis/quarterly update during earnings season) every Saturday or Sunday. This remains unchanged from last year, is still our most comprehensive post, and is available to all subscribers!

Occasional additional analysis during earnings season.

The bi-weekly ‘InvestInsights Bargain Radar.’ This new format will, in each addition, line up and discuss three stocks that are compelling for one reason or another due to a significant drop or significant development, for example. This will be short, snappy, and straight to the point, with the goal of introducing you to new stocks you might not have considered before but that are compelling right now. Each month, one of these will be for all subscribers, while the other will be exclusively for paid subscribers.

Paid content:

Apart from the new format I just pointed out, of which one each month will be exclusively paid, paid subscribers will get access to my full portfolio allocation, monthly transactions, and personal thoughts and actions.

Instant buy and sell updates in the subscriber chat, as well as additional thoughts and ideas.

At least two more premium stock analyses monthly.

In other words, for all subscribers, plenty more content is coming in 2025. In 2024, you all received a whopping 116 analyses in your inbox. In 2024, that number should grow to well over 120! (for the record, that means that paid subscribers, with a current fee of $50 annually, pay less than $0.50 per analysis. You won’t find that cheaper;)

On that note, I think we’re about ready to discuss the 2024 and December market performance reviews. First, let me give you a final reminder that our paid tier pricing will increase as of January 9th.

To account for the additional content and effort, I will be forced to raise prices for new subscribers. (I currently charge the substack minimum, but that is no longer sufficient.)

However, I am committed to never raising prices for existing subscribers. If you upgrade to paid before January 9th, you’ll lock in the current prices forever or until you unsubscribe. That means you only pay $5 monthly or $50 annually for over 120 articles a year full of premium insights.

A bargain, right?

As of January 9, these will be the new paid subscription prices:

Monthly → $7.50

Annually → $70

A reflection on December and 2024

No real end-of-year rally in 2024.

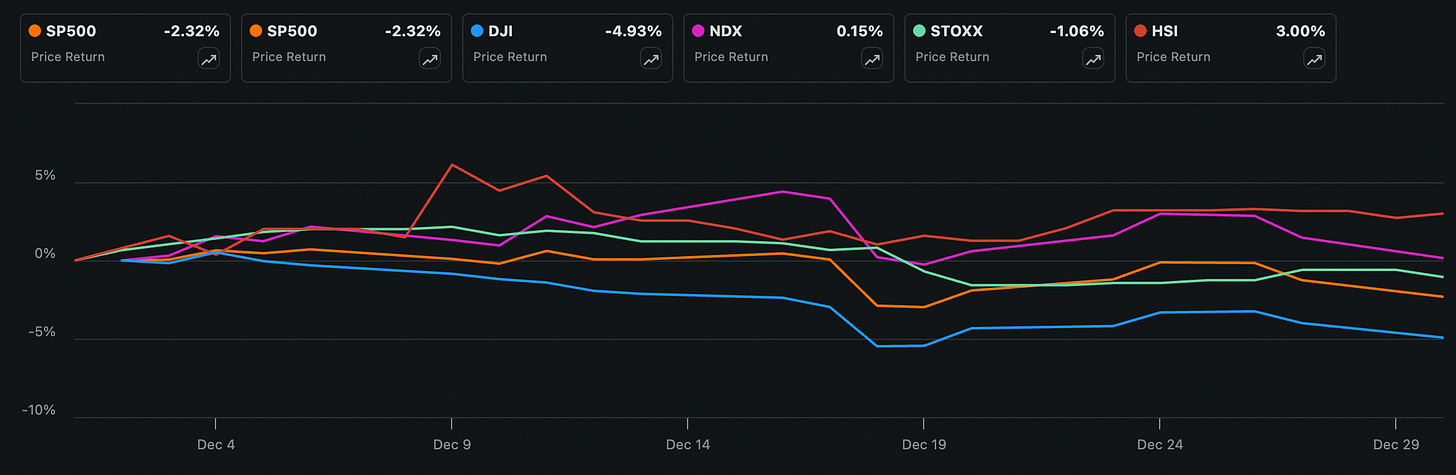

Instead, the S&P500, together with most global benchmarks, registered a loss in December, mitigating some of those sweet November gains when the index gained almost 5%. The leading reason for this poor sentiment and the subsequent decline was a reduction in rate-cut expectations by the U.S. Federal Reserve for 2025.

Whereas the Fed cut rates in line with expectations during its most recent meeting, its updated dot plot disappointed investors as it shows a rate cut of only 50 bps in 2025, whereas previous guidance pointed to a 100 bps cut, meaning interest rates will remain relatively high by the end of 2025, by current expectations, and rightfully so.

Ultimately, while there was great progress in bringing down inflation in early 2024, this somewhat stagnated in the latter half of the year. Core PCE now continues to hover around the 2.7% to 2.8% range, which is well above the Fed’s targeted range and not showing enough progress to keep cutting rates, especially with a resilient labor market.

However, these higher rate projections did put additional pressure on stocks as they temper growth expectations, especially for the technology sector. Other factors, such as geopolitical risks, multiple ongoing wars, and economic uncertainty, aren’t helping sentiment, either, although the U.S. indices have seemed immune to all these uncertainties and headwinds for most of 2024.

Nevertheless, it all was a bit too much in December and markets dropped a few percentage points of their 2024 gains, which maybe wasn’t all that bad anyway.

Notably, for once, technology didn’t lead the decline. In fact, the Nasdaq was among the view indexes that delivered a minor positive return in December.

Here is a full overview of the December index performance:

While not really pretty, investors have had little to complain about for most of 2024, with most global indexes delivering pretty neat returns. It most certainly was way above my January 2024 predictions, as well as those of Wall Street analysts.

While probably only read by our three subscribers at that time, we did actually issue some end-of-2024 predictions in January 2024. I wrote the following in my very first Substack post:

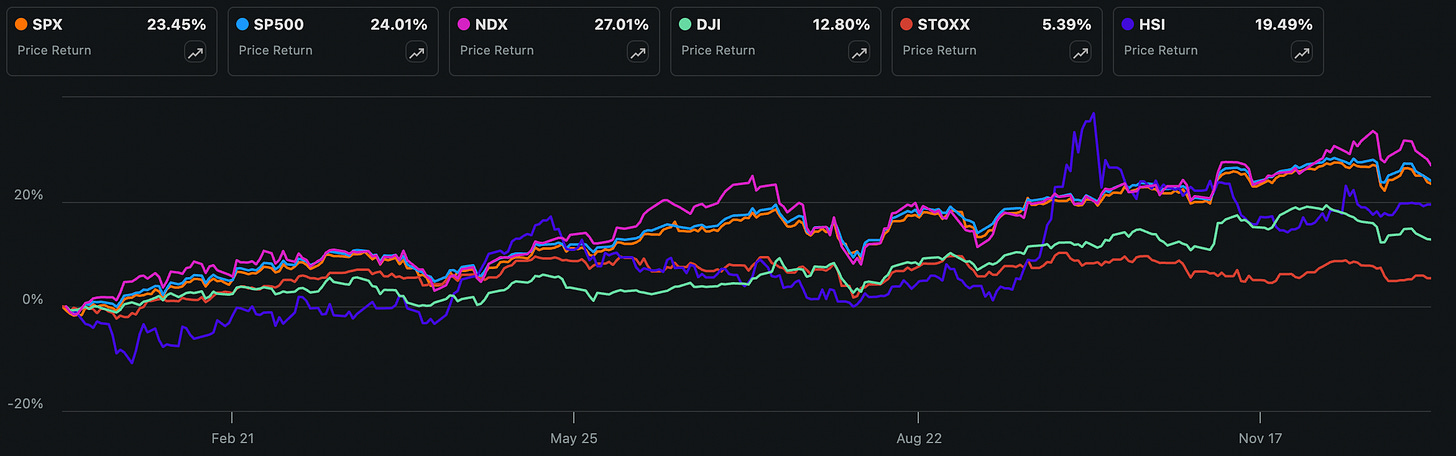

“With the markets facing all these uncertainties, we are taking a more careful stance by projecting an end-of-2024 S&P500 value of 5,000, representing a 4-5% increase. However, if inflation does come down, interest rates drop in line with what is currently priced into the market, and global conflicts don’t take a turn for the worse, we acknowledge there is much upside and room for margin expansion. This could lead to the S&P500 gaining as much as 9% to 5,200.”

And here’s what some Wall Street analysts projected:

Goldman Sachs: 4,500

Deutsche Bank: 4,500

Bank of America: 4,300

JP Morgan: 4,200

UBS: 3,900

Barclays: 3,725

It's safe to say we were all too conservative and that these predictions are completely useless. The S&P500 ended the year just shy of 6,000, well ahead of even the most bullish predictions and well ahead of my most optimistic projection.

Ultimately, most global benchmarks delivered double-digit returns in 2024, with the S&P500 and Nasdaq leading the pack, returning well over 20% to investors.

Here is an overview of the 2024 performance by leading indexes:

The most important takeaway?

Ignore market predictions or economic forecasters. The market is irrational, emotional, and unpredictable. Predicting the market 12 months away is impossible and pure guesswork.

Subsequently, always stay invested. Don’t try to time the market. Most of you will fail to do so, and even missing a couple of the best trading days can half your long-term returns. Don’t bother. Focus on buying high-quality businesses at a fair price or, ideally, a discount, and stick to your plan.

Let’s hope 2025 will be just as good!

Here is an overview of our December posts, in case you missed any:

Salesforce, Inc. – The new leader in AI, but optimism might have been overdone

Lululemon Athletica, Inc. – Still an ultra-high-quality fashion business (Paid)

Here are three stocks I am buying today! (The best-read and most-liked article of 2024)

Oracle Corporation – This business has transformed into a long-term winner (Paid)

Broadcom Inc. – A Deep Dive into this technology conglomerate

2025 Goals & expectations

And then it’s time to shift our focus to what’s ahead - 2025. After 2024 marked the second year in a row of a 20%+ gain for the S&P500 for the first time since 1998, is it possible to make it three in a row in 2025?

While last year proved that it is impossible to predict, I will say I am neither too optimistic nor too pessimistic.

You see, there are still plenty of headwinds or risks hanging over the market, enough to disrupt this optimistic sentiment that ruled in 2024. I have said it many times by now, but geopolitical tensions remain at multi-decade highs thanks to multiple ongoing conflicts around the world. In addition, as pointed out before, inflation is sticky, leading to an uncertain rate cut trajectory. The new Trump administration and the tariff plans are no positive additions to this, either.

In other words, this isn’t going to be a straightforward year, neither positive nor negative, and I am anticipating quite a bit of volatility with plenty of highs and lows.

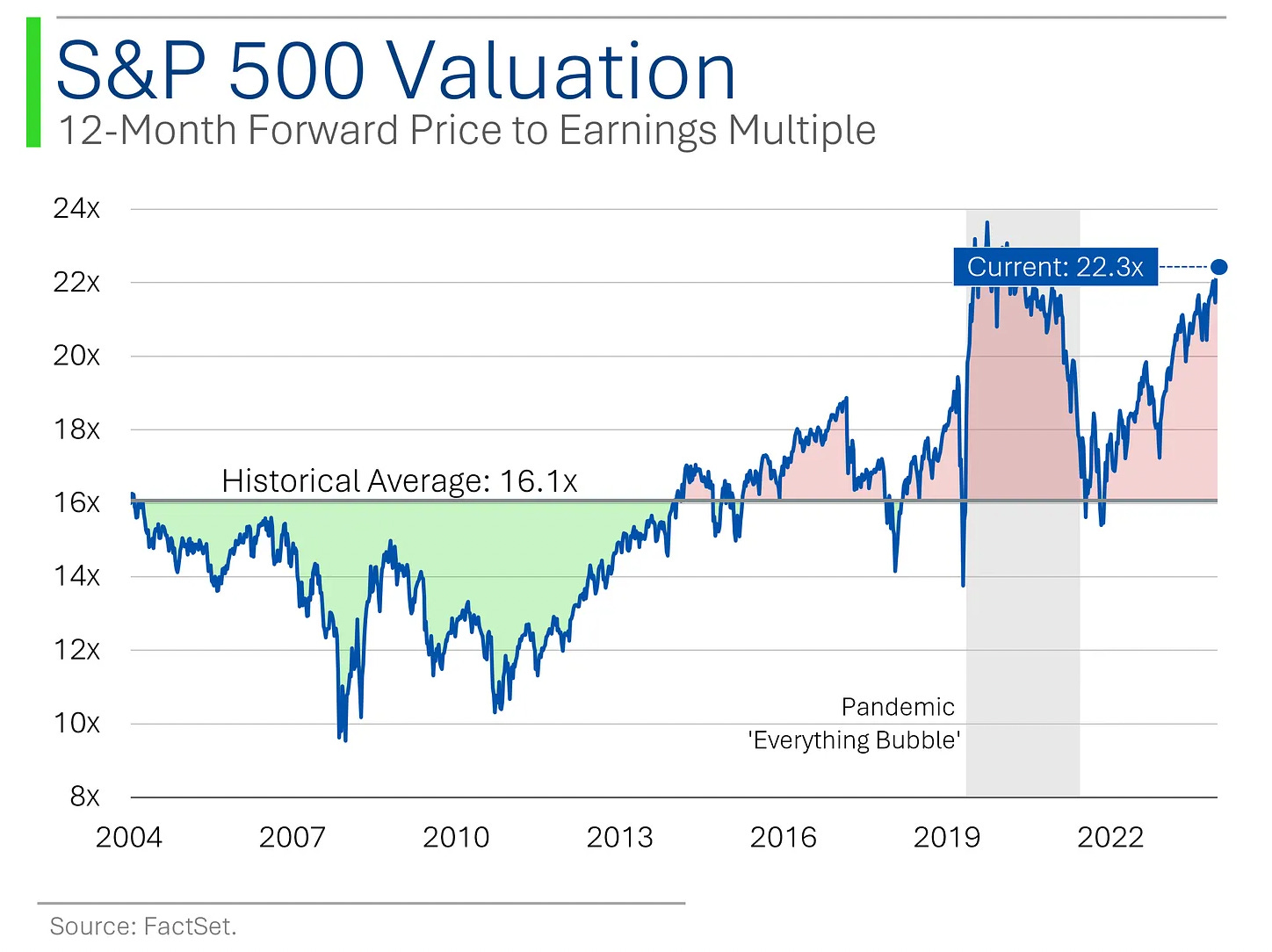

Also, after the great gains in recent years, there is no denying markets are bloody expensive overall. The S&P 500 now trades at over 22x the 12-month forward earnings, which is a really hefty premium to pay. For reference, in recent memory, we have only seen such multiples during the DotCom bubble and COVID hype, and that didn’t end well.

perfectly illustrated this in the graph below in a recent post.

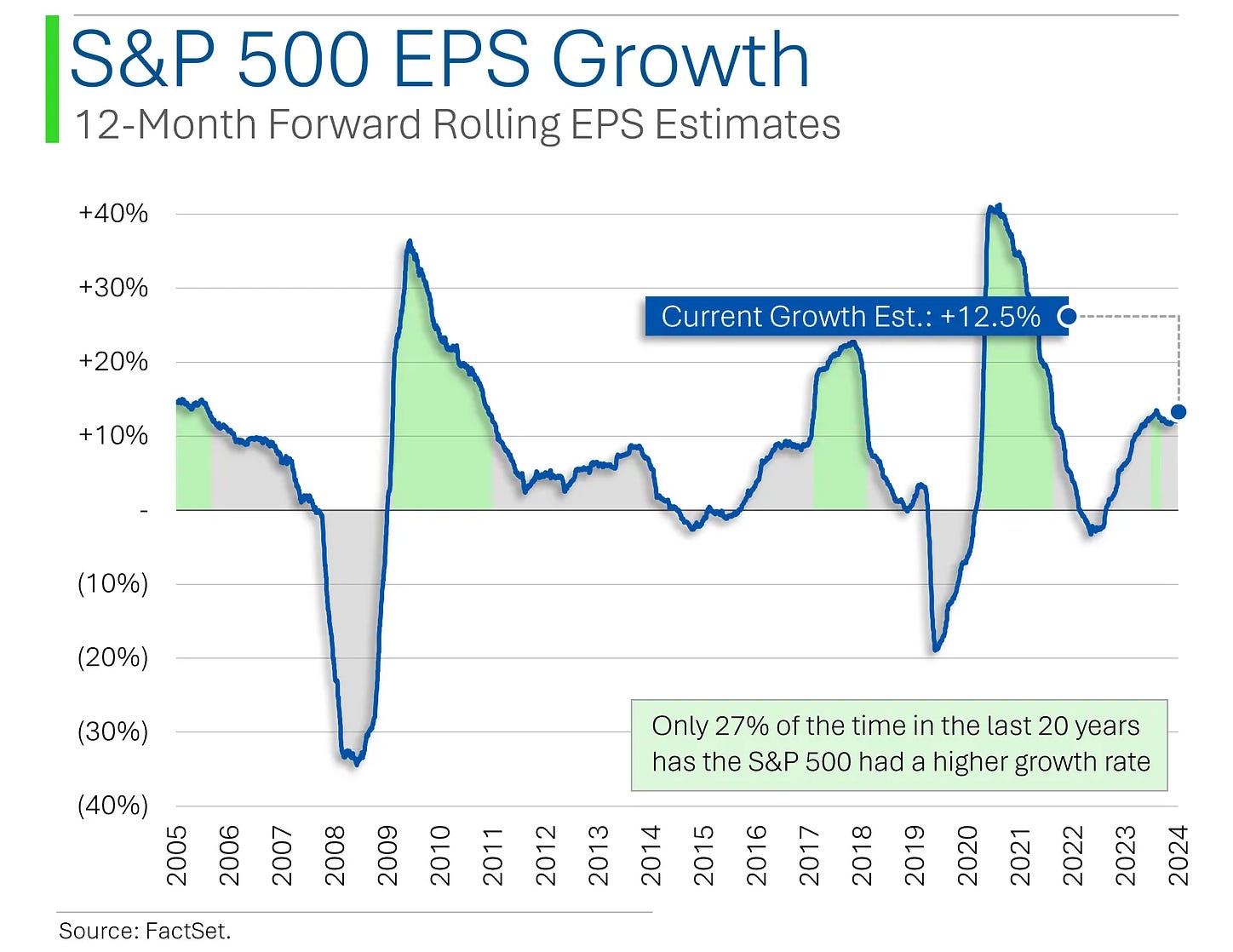

Alright, the market's premium can be somewhat explained by forward growth expectations, which are pretty high at 12.5% for the S&P500 companies. Again, this is something we haven’t seen that much over the last two decades.

Again, this was beautifully illustrated by the graph below from

.

Nevertheless, considering the risks to these optimistic projections, markets are trading at really rich multiples, which are very hard to justify. Unless all these risks slowly disappear—geopolitical conflicts ease, inflation comes down—and impressive earnings growth persists, these multiples just can’t be justified.

Even under an optimistic scenario, I believe double-digit returns in 2025 aren’t a given. But also, what do I know….

I can tell you with certainty that my strategy for 2025 remains unchanged. I will continue to look for great businesses with healthy cash flows and plenty of growth potential at attractive valuations.

Ultimately, no matter the state of the market and economy, there are always gems to be found!

The goal for 2025?

Similar to previous years, I aim to outperform global benchmarks.

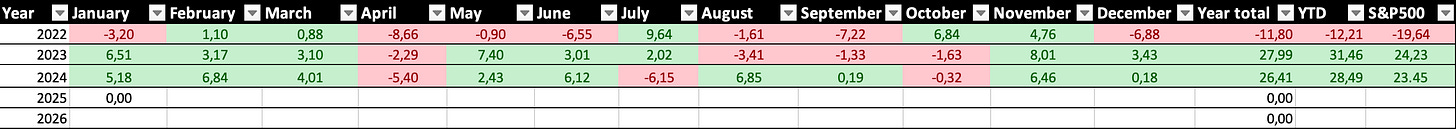

Portfolio performance in December

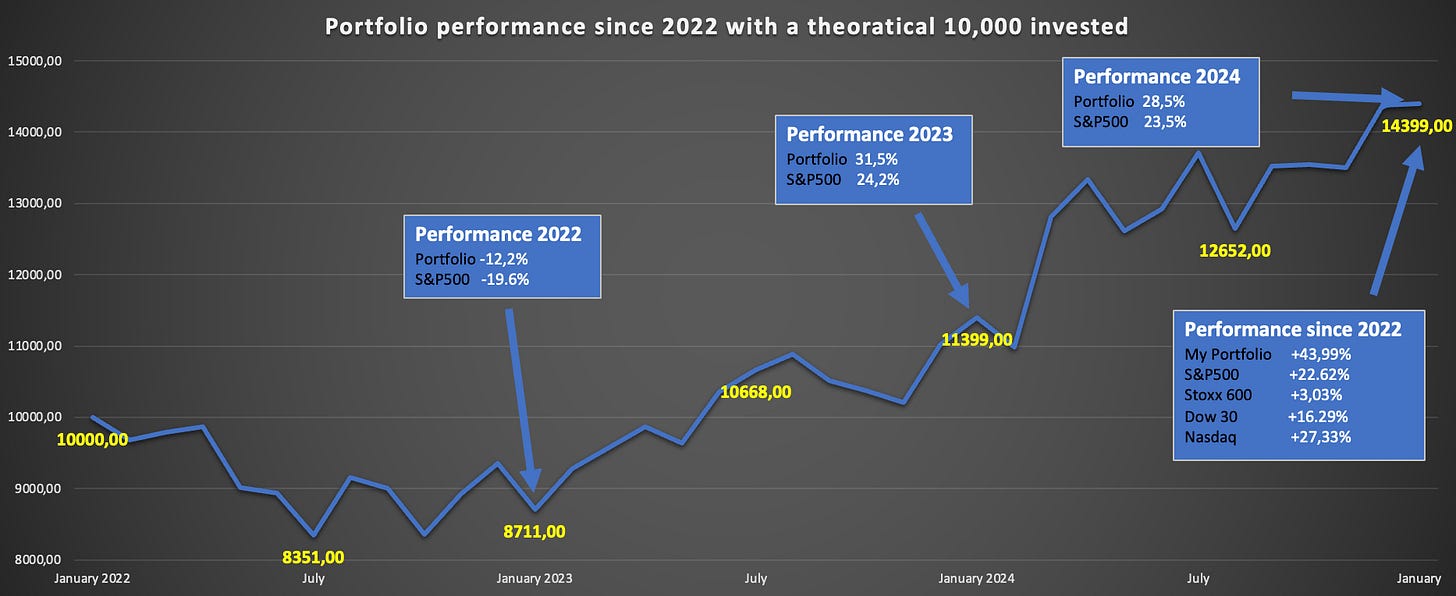

Before moving to the premium section of this post, I just want to quickly touch on my portfolio’s performance over December, which, similar to the market, wasn’t all too great, but at least it outperformed.

For December, my portfolio returned 0.18%, well ahead of most leading global benchmarks.

S&P500 → -2.7%

Dow 30 → -5%

Nasdaq → -0.7%

Stoxx Europe → -1%

That brings my portfolio return to 28.5% for the year, well ahead of most benchmarks, with the S&P500 returning 23.5% and the Nasdaq just under 28%.

This marks the third consecutive year of outperformance. Since its inception on January 1st, 2022, the portfolio has returned 44%, again, well ahead of all leading global benchmarks, as visualized below.

On that note, let’s delve into the actual portfolio, which is exclusively for paid subscribers.