Portfolio Update Nov. 2024

As always, at the start of each month, here is an update on my portfolio allocation, monthly transactions, and portfolio performance for October!

Welcome back, everyone, to my monthly portfolio performance and allocation update.

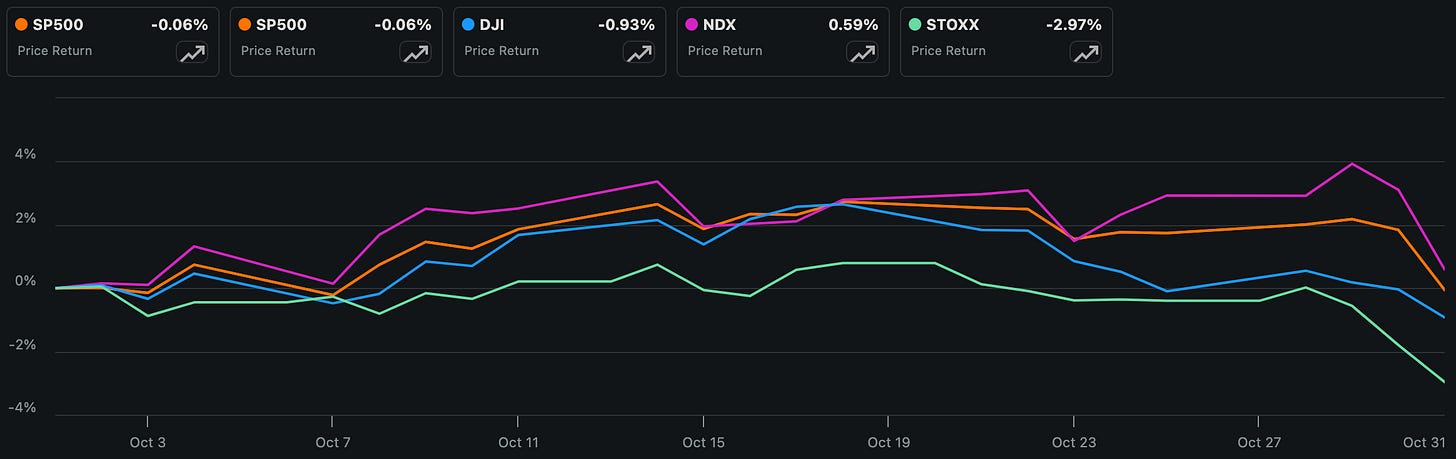

There is once more plenty to talk about after a somewhat volatile October (as expected) driven by macroeconomic data looking for direction and third-quarter earnings causing above-average levels of volatility with hefty share price reactions. Notably, earnings day stock movements have reached the highest level in 15 years in recent weeks.

Halfway through the month, this led to both the Nasdaq and S&P500 setting fresh new all-time highs, while European indices were once more sluggish, falling behind.

Unfortunately, these highs didn’t last very long. By the end of the month, technology stocks, particularly the semiconductor sector, once again showed some weakness. In the last two trading days of October, the SMH (Van Eck semiconductor ETF) index shed an exorbitant 3.5%, with the Nasdaq shedding some 3.4%.

As a result, global indices largely ended October marginally lower, while the STOXX Europe 600 was down more significantly at -3%.

Nevertheless, for the year, we are still looking at very compelling and above-average returns. Here’s the YTD performance of large indices:

S&P500 → 20.30%

Nasdaq → 20.23%

Dow 30 → 10.73%

STOXX Europe 600 → 5.51%

Han Seng → 22.89%

All in all, there is not too much to complain about, especially considering global economic weakness and geopolitical tensions.

Let’s delve into the performance of my own portfolio, but first, here is a quick overview of all the analyses and posts you might have missed last month. Amid the earnings season, there are quite a few!

Oh, yes, all of these are now FREE through the links below.

Oracle Corporation - Is the hype justified, or is it time to take profits?

EssilorLuxottica (EL) – This company has an unparalleled moat (A Deep Dive)

ASML Holding N.V. – Here is my take after the Q3 earnings and a 20%+ sell-off

I am buying LVMH shares today, and here’s why! (Q3 Earnings Analysis)

The Procter & Gamble Company – A brilliant business at a hefty price tag (Earnings Analysis)

Texas Instruments Inc. – An absolute gem in the semiconductor industry (A Deep Dive)

Lam Research Corp. – Now undervalued and poised for outperformance!

Also, make sure to check out my latest coverage of Starbucks from earlier this week! It’s a great read.

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe, and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

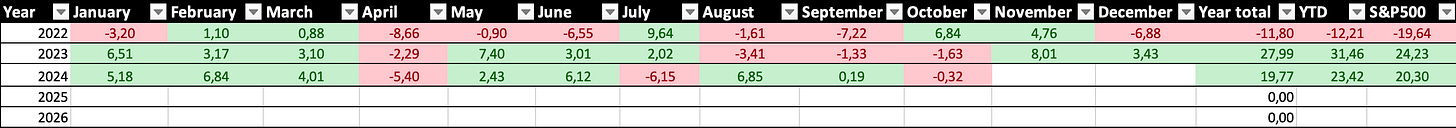

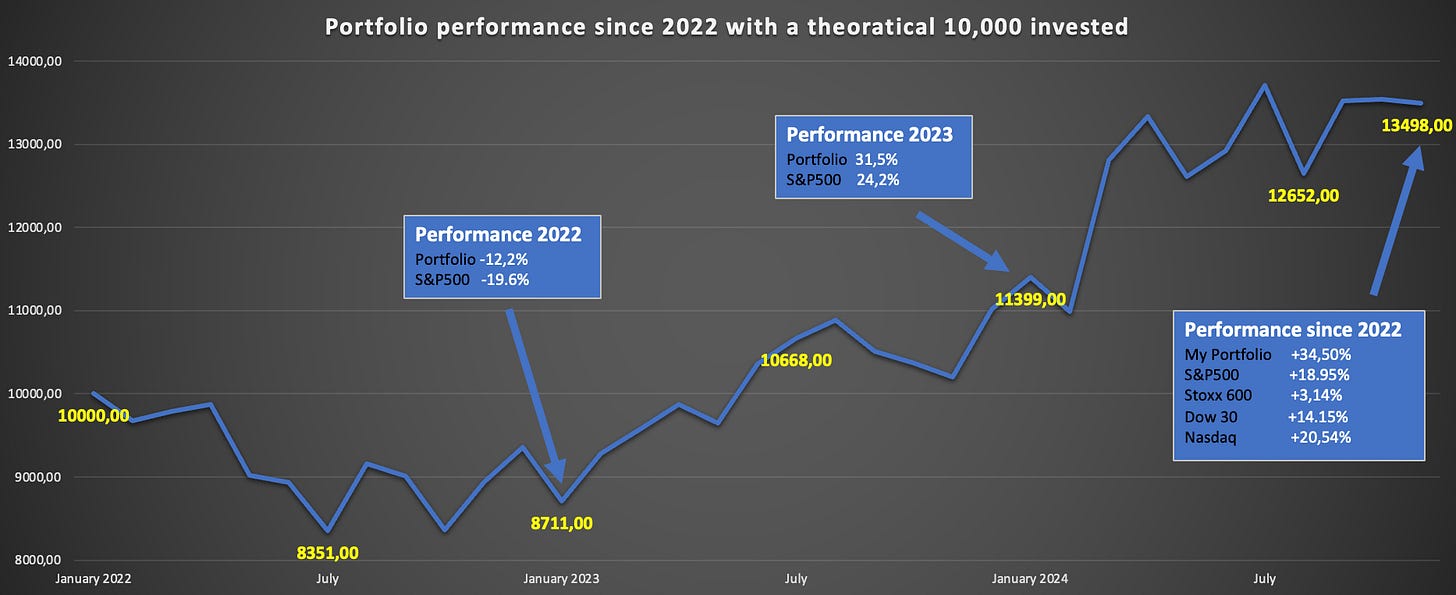

My Portfolio Performance For October (-0.32%)

Now, let’s finally move to my portfolio, starting with the monthly performance, which took quite a hit in the last few trading days as well due to significant exposure to technology sectors and semiconductors in particular.

Whereas this has been a great tailwind in recent years and quarters, in September and October, my exposure to the semiconductor industry negatively impacted my overall performance. This has mainly been the result of mounting worries over the U.S. export restrictions and a recovery that is progressing slowly and with limited forward visibility.

I expect these struggles to be temporary and remain very bullish on the industry’s long-term prospects, though I do believe volatility might remain high for a few more months as investors look for a direction.

Moving back to last month’s performance, these end-of-month hiccups eventually led to a 0.32% decline in portfolio value in October, roughly in line with the S&P500 and keeping the performance stagnant for another month after only a marginal uptick in September.

Furthermore, this translates into returns of 23.42% YTD, which outpace the S&P500 by about 300 bps, mostly due to a rapid start to the year. Not too bad.

Also, looking at my performance since starting this portfolio in January 2022, I continue to far outpace any benchmark, returning a total of 34.5%, a performance I am still quite pleased about, even as the last two months have been far from great.

Looking at the recent performance, there has, of course, been the influence of the earnings season, which hasn’t been especially favorable, with a few key holdings, such as LMVH and ASML, missing expectations and experiencing quite significant sell-offs.

Meanwhile, other positions, such as Booking Holdings or Texas Instruments, performed significantly better, but still, post-earnings movements have been a net negative so far.

In addition, as pointed out earlier, the drop-off and volatility of semiconductor stocks continue to pressure the portfolio, which has a 20%+ allocation to this sector. I expect this volatility to persist through the last few months of 2024.

Apart from this, there haven’t been too many notable movements.

On that note, let me finally show you the updated allocation and a full overview of my October transactions, explaining the most notable ones.

My Portfolio as of November 1st

Starting with all my transactions, here is an overview: